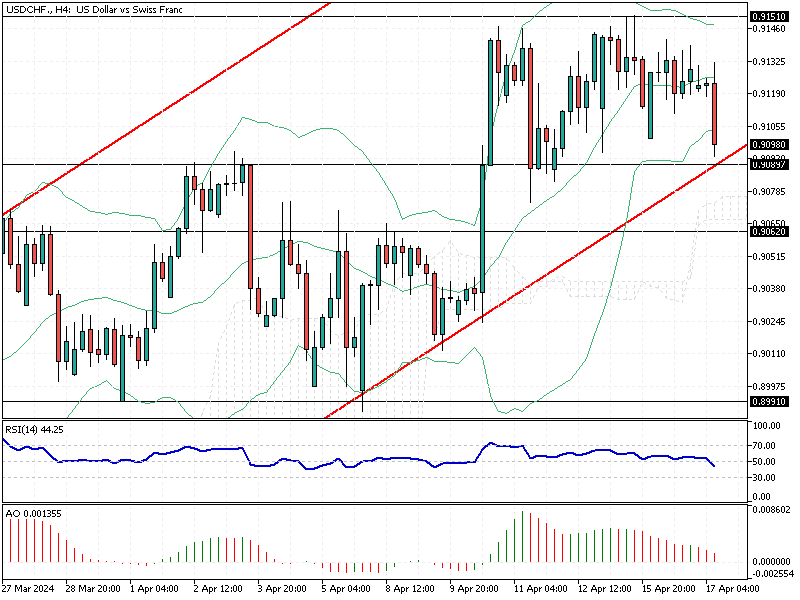

USDCHF Analysis – US Inflation Impact on Swiss Franc

USDCHF Analysis – The Swiss franc has weakened significantly, falling past 0.91 against the US dollar, marking its lowest value in over half a year. This decline comes as the United States faces rising inflation rates, which starkly contrasts with the economic situation in Switzerland.

In Switzerland, inflation has dropped to its lowest level in over two years, reaching just 1% in March, which fell short of the market’s expectations of 1.3%. This drop in inflation aligns with the Swiss National Bank’s (SNB) ongoing statements that underlying inflation pressures are easing.

Swiss Economy: Decline Amidst Unexpected Rate Cuts

The economic outlook in Switzerland is not entirely positive, as evidenced by declining business confidence and a decrease in retail sales. These factors support the speculation that the SNB might soon consider increasing interest rates. Despite this, the franc’s value dropped sharply after the SNB unexpectedly cut rates in March, which set it apart from other major central banks during the current global inflation scenario.

The lower inflation has also allowed the SNB to reduce its interventions to support the franc. This change is reflected in the increase of foreign currency reserves over the past three months, following their dip to a seven-year low last November.

The Swiss franc may face further challenges as the US and Switzerland continue on divergent economic paths. Investors and policymakers closely monitor these developments, influencing decisions in the coming months.