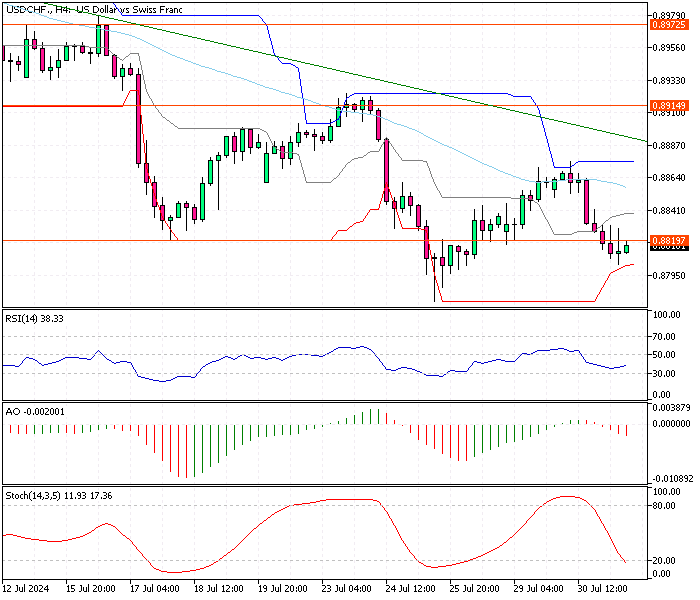

USDCHF Analysis 31-July-2024

The Swiss Franc has strengthened to around $0.88 (USD/CHF), marking its highest point since the Swiss National Bank (SNB) lowered interest rates on June 20th. This increase is partly due to the unwinding of carry trades, where investors borrowed Swiss Francs to invest in higher-yielding currencies.

USDCHF Analysis 31-July-2024

On the other hand, the US dollar has experienced its lowest value in four months. This decline is driven by traders expecting several interest rate cuts from the Federal Reserve (Fed) this year. These expectations have been fueled by several soft statements from Fed officials, including Fed Chair Jerome Powell.

Powell mentioned that recent economic data has increased the confidence that inflation will return to the desired level. He also stressed that the central bank will not wait for inflation to reach 2% before cutting rates.

For those new to these concepts, a carry trade involves borrowing money in a currency with low interest rates (like the Swiss Franc) and investing it in a currency with higher interest rates to profit from the difference. When these trades are unwound, investors reverse their positions, which can impact currency values.

Central banks use interest rates as a crucial tool to control economic activity. When a central bank cuts interest rates, it aims to stimulate economic growth by making borrowing cheaper. This can lead to lower currency values as investors seek higher returns elsewhere.

Understanding these dynamics helps explain why the Swiss Franc has risen while the US Dollar has fallen. Investors adjust their strategies based on the expected moves of central banks.