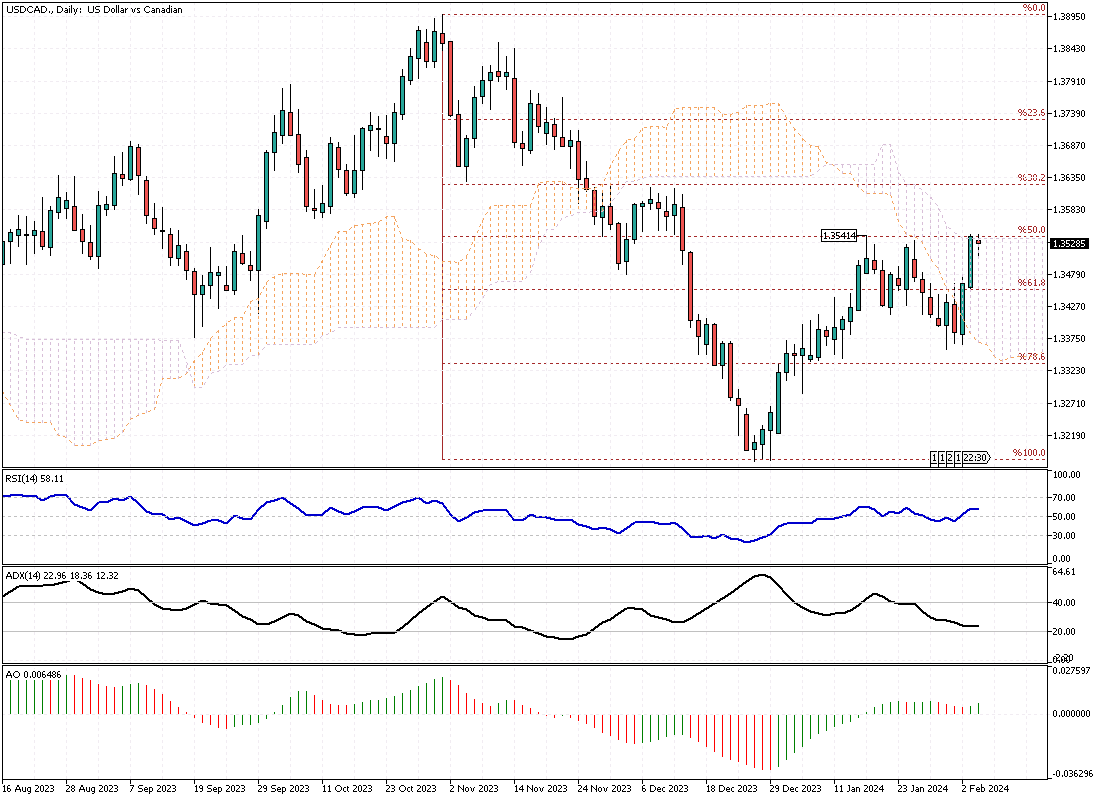

USDCAD Analysis – February-6-2024

USDCAD – In early February, the Canadian dollar decreased in value, crossing the 1.35 mark against the US dollar. This drop, the lowest in over a month, came after the US shared solid economic data and the Federal Reserve commented that high interest rates in the US might continue.

This scenario favored the US dollar. Specifically, the US service sector showed unexpected growth, and inflation was higher in January, aligning with Federal Reserve Chair Powell’s remarks that it’s too soon to consider inflation entirely under control.

Comparing Economic Indicators

While the US boasted positive economic indicators, Canada faced a different story. The data revealed that Canada’s private sector was shrinking, signaling a challenging economic environment. This situation has led to calls for the Bank of Canada to adopt a softer approach to its monetary policy. A more accommodating policy could help stimulate economic growth by making borrowing cheaper and encouraging investment and spending.

Oil Prices and International Developments

The oil price, a critical factor for Canada’s economy, didn’t provide much support for the Canadian dollar either. Speculation about a possible ceasefire between Hamas and Israel lessened worries over oil supply disruptions. Usually, concerns about supply would increase oil prices, benefiting oil-exporting countries like Canada by bringing in more foreign currency. However, easing these concerns meant that the Canadian dollar often called the loonie, didn’t get this potential boost.

The subdued oil prices, combined with the economic indicators, paint a picture of why the Canadian dollar has weakened and what might be influencing its value on the global stage.