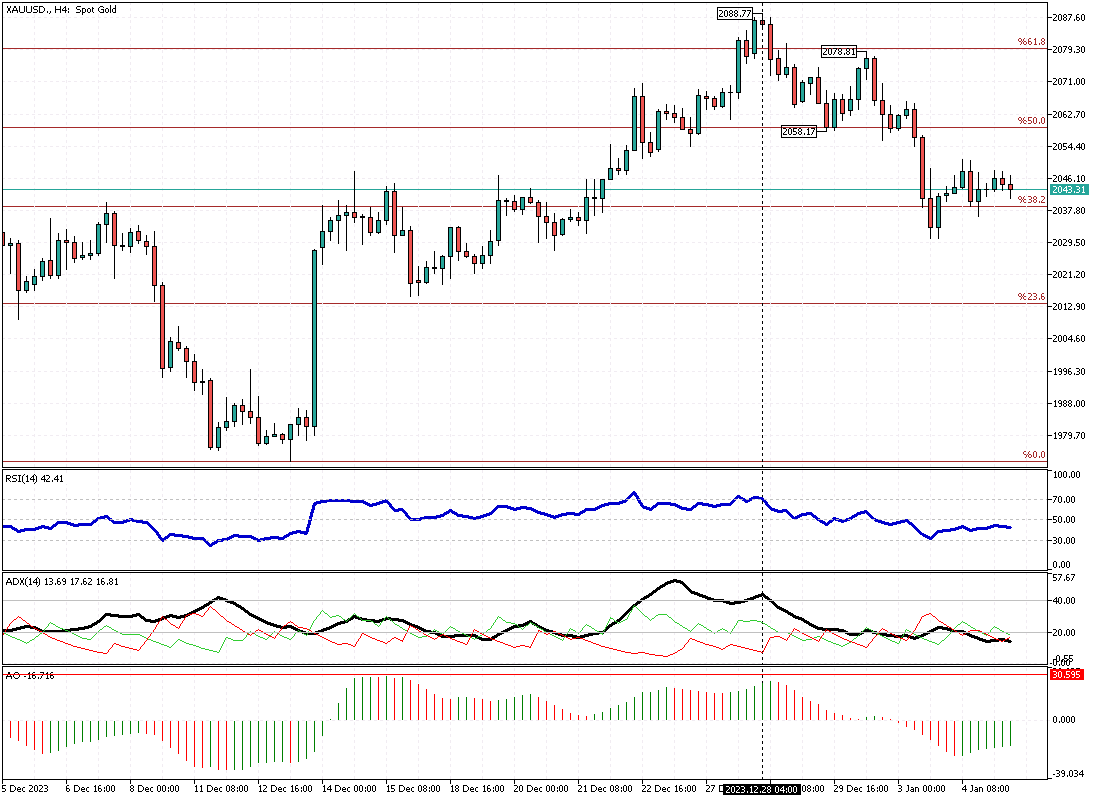

Gold Analysis – January-5-2024

FxNews – On Friday, gold‘s value held firmly over $2,040 per ounce. Despite this, the precious metal is on track for its initial weekly drop after three consecutive weeks of gains. This change is mainly due to the dollar strengthening and a rise in Treasury yields, leading investors to rethink their expectations of significant rate cuts by the US Federal Reserve within the year.

Recent statistics reveal a decrease in US weekly jobless claims, surpassing forecasts. Additionally, December saw an unexpected increase in hiring by US private companies, showcasing the durability of the job market. Attention is now turning towards the eagerly awaited monthly employment report. Predictions suggest that the US economy welcomed 170,000 new jobs in December, slightly decreasing from the 199,000 jobs added in November.

The likelihood of the Fed lowering rates in March has dipped to about 65%, a notable decrease from the nearly 90% probability anticipated just a week earlier. Meanwhile, the situation in the Middle East remains a focus for investors. Recent deadly explosions in Iran have heightened concerns over potential escalation in regional conflicts.