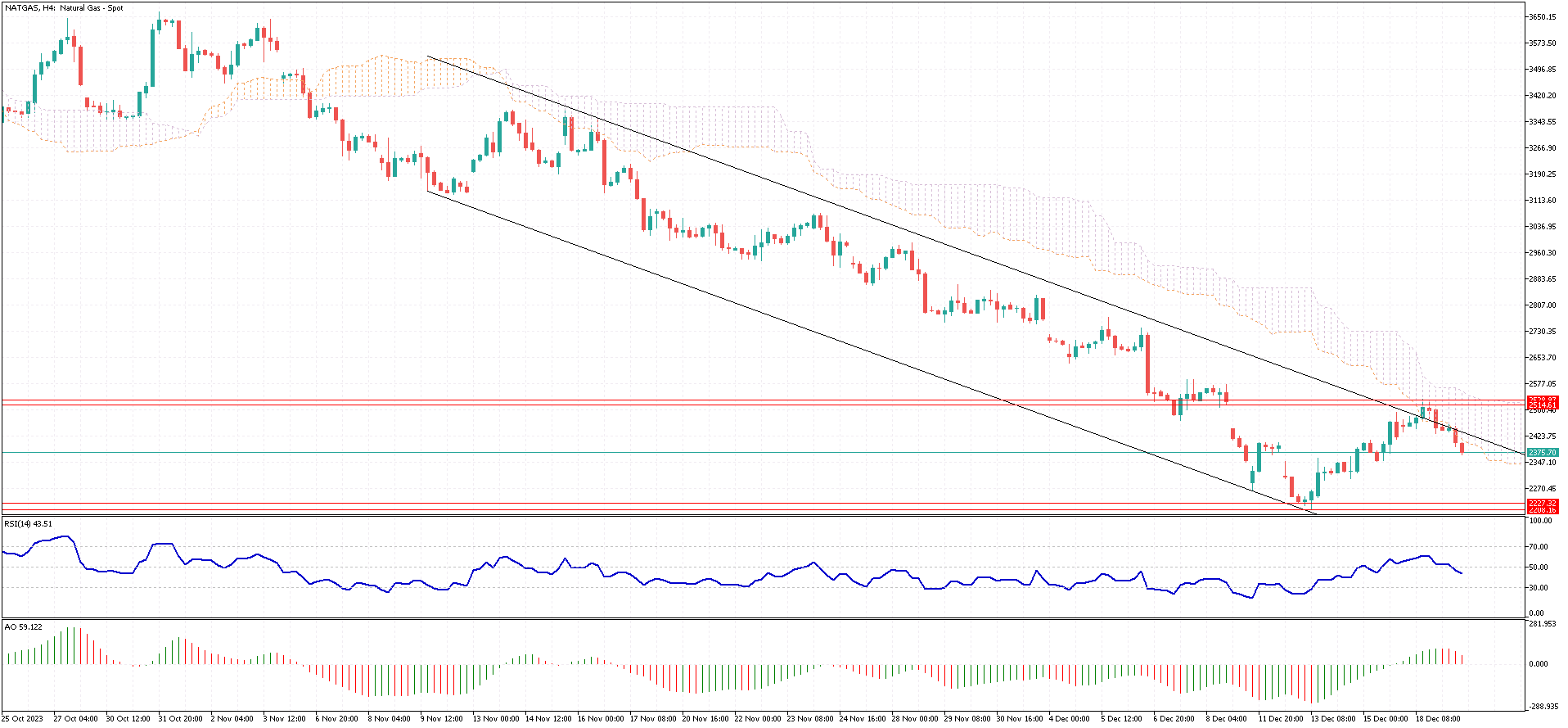

U.S Natural Gas Analysis – December-19-2023

Reuters – U.S. natural gas futures rebounded, climbing to approximately $2.5 per million British thermal units (MMBtu). This recovery comes after a significant drop to a six-month low of $2.2 last week. The increase is primarily driven by seasonal demand and a surge in gas flows to liquefied natural gas (LNG) export plants.

Expectations of continued robust exports further fuel the market optimism. LNG terminals now consume around 15 billion cubic feet daily, indicating strong demand for natural gas. This high level of consumption at LNG terminals is a positive sign for the natural gas market, suggesting a steady demand that supports higher prices.

Additionally, geopolitical tensions have had an impact on the market. Recent attacks by the Yemeni Houthi militant group in the Red Sea have raised concerns over potential disruptions in maritime trade. As a result, global freight companies have been rerouting their paths around the Cape of Good Hope. Notably, BP, one of the major oil firms, has decided to halt all its shipments through the Red Sea in response to these security concerns. This decision by BP reflects the broader impact of geopolitical events on the energy market as companies adapt to ensure the safety and continuity of their operations.