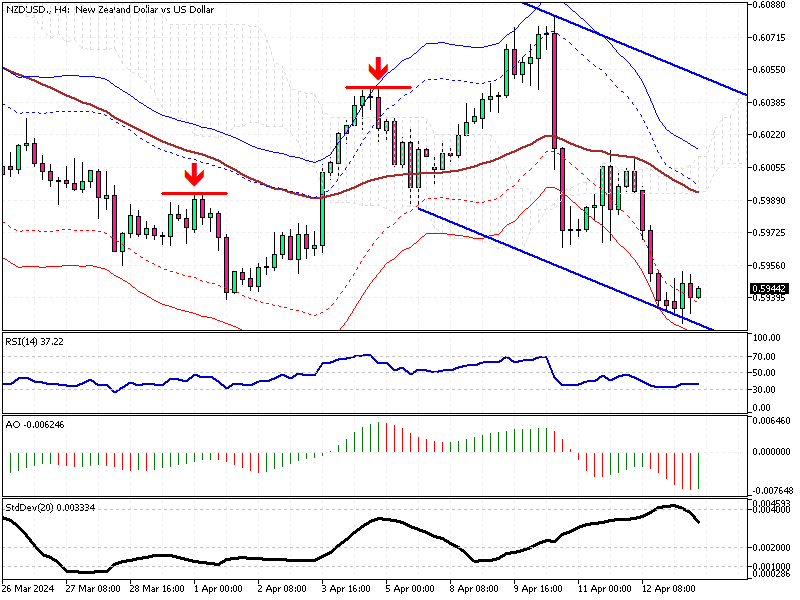

NZDUSD Stays Low Amid US Economic Strength

The New Zealand Dollar (NZD) remains suppressed below the $0.60 mark, hovering near its five-month lows due to strong economic indicators from the United States. The robust U.S. data has reduced expectations for multiple rate cuts by the Federal Reserve within the year, negatively influencing the NZDUSD dynamics.

NZDUSD Faces Headwinds, RBNZ Holds Rates

Domestically, the Reserve Bank of New Zealand (RBNZ) has opted to keep interest rates unchanged for the sixth consecutive time during its April meeting. This decision was made because the central bank aimed to address persistent inflationary pressures without aggravating weakening economic activity.

The annual inflation rate in New Zealand has moderated to 4.7% for the quarter ending December 2023, marking the lowest since Q2 of 2021 yet still significantly above the RBNZ’s target range of 1% to 3%.

Technical Recession Hits NZ Economy, NZDUSD Dips

Compounding the currency’s challenges, New Zealand’s economy has slipped into a technical recession as of the fourth quarter, with the latest services activity data indicating the most severe contraction since January 2022. This downturn in economic performance adds further stress to the NZDUSD exchange rate as investors adjust their expectations around New Zealand’s financial resilience.

The NZDUSD pair remains sensitive to domestic economic developments and external economic conditions, especially the U.S. economic outlook and the Federal Reserve’s monetary policy decisions.

As investors recalibrate their bets on the Federal Reserve’s actions, moving the anticipated start of the easing cycle to September, the NZDUSD could face continued volatility. Investors are advised to keep a close eye on upcoming economic releases from both New Zealand and the United States, as these will likely be key drivers of the currency pair’s movements in the near term.