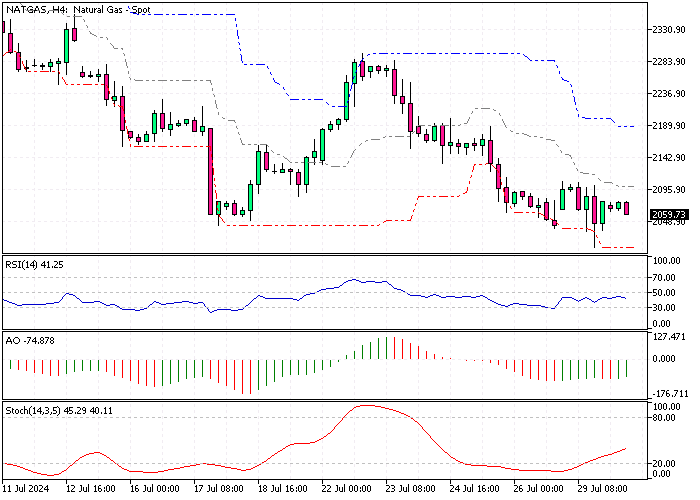

NATGAS Analysis 30-July-2024

The price of natural gas futures in the US has risen above $2.05 per million British thermal units (MMBtu). This rise came after falling prices dropped to nearly $2, marking a three-month low.

The price increase is mainly due to concerns about the supply from major gas exporting regions, which has driven up demand for US liquefied natural gas (LNG).

NATGAS Analysis 30-July-2024

Global gas markets are currently facing several disruptions. One significant issue is the partial shutdown of the Ichthys LNG plant in Darwin, Australia. This plant is crucial as it has two processing units, known as trains, and one is currently out of operation. Additionally, there have been ongoing problems in Norwegian gas fields, further reducing the supply available to important gas-importing countries.

At the same time, Freeport LNG, the second-largest export facility for US natural gas, has been ramping up its operations. This facility is pulling in over 2 billion cubic feet of gas daily and is expected to return to total production soon.

As US LNG exporters increase their capacity, they can sell more gas to international buyers. This, in turn, creates more competition for gas within the US, as domestic consumers now have to compete with foreign buyers.

In another development, the latest report from the US Energy Information Administration (EIA) revealed that US utilities have added 22 billion cubic feet (Bcf) of gas into storage over the past week.

This increase in storage levels exceeded market expectations, which had predicted a more minor addition of 15 Bcf. As a result, the current gas storage levels in the US are now 16.4% higher than the average for the past five years.

The rise in US natural gas futures can be attributed to increased demand due to supply uncertainties in other parts of the world and the expansion of US LNG export capabilities. These factors, along with higher-than-expected gas storage levels, influence the natural gas market dynamics.