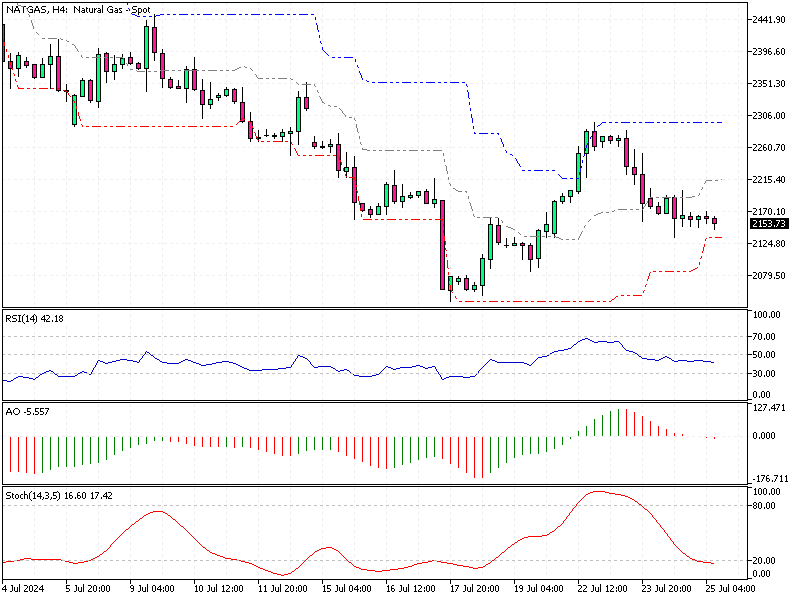

NATGAS Analysis 25-July-2024

U.S. natural gas futures have dropped to $2.2 per million British thermal units (MMBtu) because of increased production and an abundance of gas in storage. Currently, there is about 17% more gas stored than is typical for this time of year.

NATGAS Analysis 25-July-2024

This surplus remains despite smaller gas injections in recent weeks. Producers had cut back earlier this year when prices were at a 3-1/2 year low. However, higher prices in April and May encouraged companies like EQT and Chesapeake Energy to ramp up their production again in June and July.

The price decline has been somewhat offset by a rise in gas exports from U.S. liquefied natural gas (LNG) plants, including the Freeport LNG facility in Texas. Additionally, predictions of extreme heat in August are expected to increase the demand for gas as more electricity will be needed to run air conditioners.

Furthermore, with lower wind power output, there has been a greater reliance on gas-fired power plants. This week, gas-fired plants generated 48% of the country’s electricity, compared to 46% last week and 41% for the same period in the previous year.