Japanese Yen Rises Amid Market Uncertainty

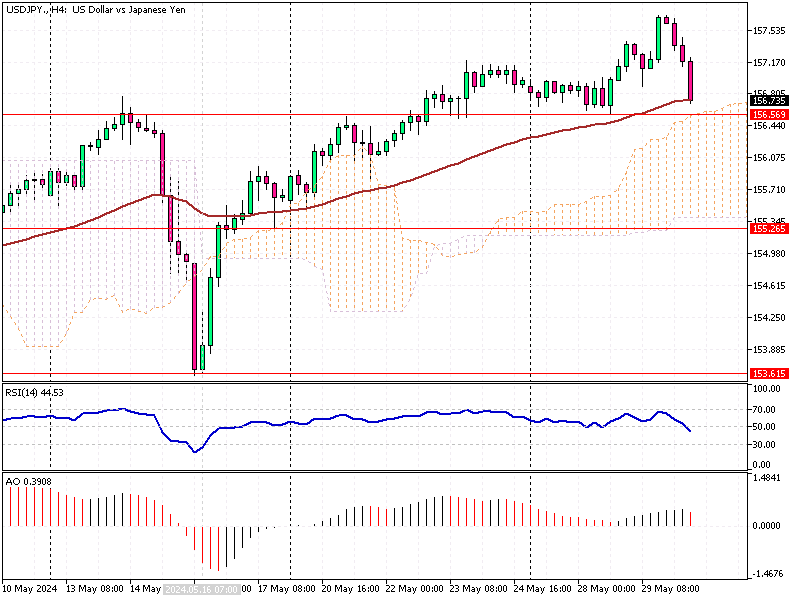

The Japanese yen appreciated past 157 per dollar (USD/JPY), recovering from four-week lows. This rebound was fueled by a broad selloff in risk assets, leading to safe-haven buying of the yen.

Japanese Yen Rises Amid Market Uncertainty

Japanese Yen Rises Amid Market Uncertainty

The currency also gained support from increasing domestic yields, with Japan’s benchmark 10-year yield reaching 1.1% this week—the first time since July 2011.

Earlier this week, Bank of Japan board member Seiji Adachi suggested that the central bank might raise interest rates if sharp declines in the yen lead to further inflation. This statement adds to the cautious optimism surrounding the yen. Investors are now focusing on Tokyo’s inflation data, which is set to be released on Friday. This data is viewed as a leading indicator of nationwide price trends.

However, the yen still faces pressure from a strong dollar and rising U.S. Treasury yields. Expectations are growing that U.S. interest rates could remain high for an extended period. A Federal Reserve official also hinted that the central bank might raise rates further if inflation surges.