Inflation Data Pushes Canadian Dollar Down

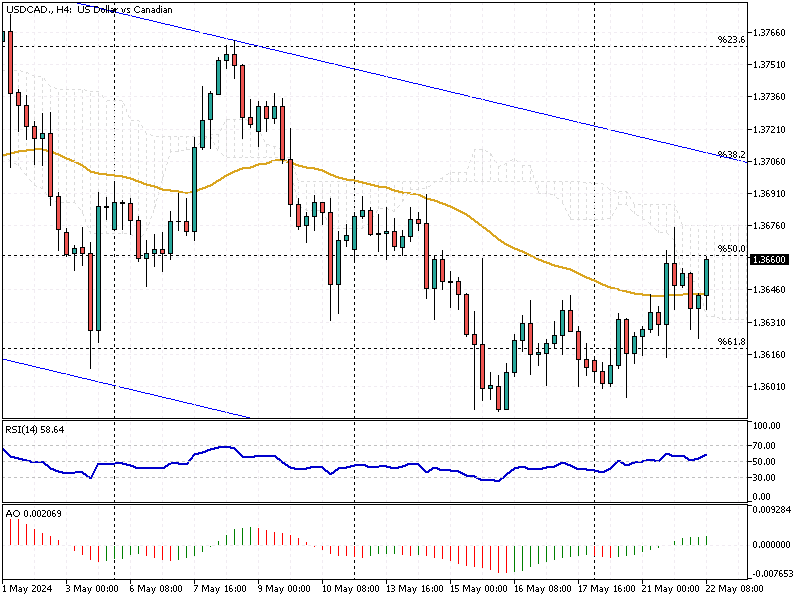

The Canadian dollar has slipped to above $1.36 (USD/CAD), moving away from the five-week highs seen earlier this month. This shift comes as recent inflation data has fueled speculation that the Bank of Canada (BoC) might lower interest rates soon.

Inflation Data Pushes Canadian Dollar Down

In April, headline inflation in Canada slowed to 2.7%, the lowest in three years. The core inflation rate dropped for the fifth month, reaching 1.6%, the lowest since 2021. These figures were in line with expectations, but they have increased the likelihood of the BoC adjusting its monetary policy.

Bank of Canada’s Stance

The BoC held its key interest rate steady at 5% in April. However, policymakers have emphasized the need for further and sustained reductions in core inflation before considering a rate cut. Despite this cautious stance, market bets for a rate cut in June have risen to 48%, up from 40% before the inflation report.

What This Means for Traders

The weakening of the Canadian dollar and the potential for a rate cut offer crucial insights for forex traders and investors. Monitoring upcoming economic data and BoC statements will be essential for making informed trading decisions.