Gold Retreats Amid Rising Interest Rates

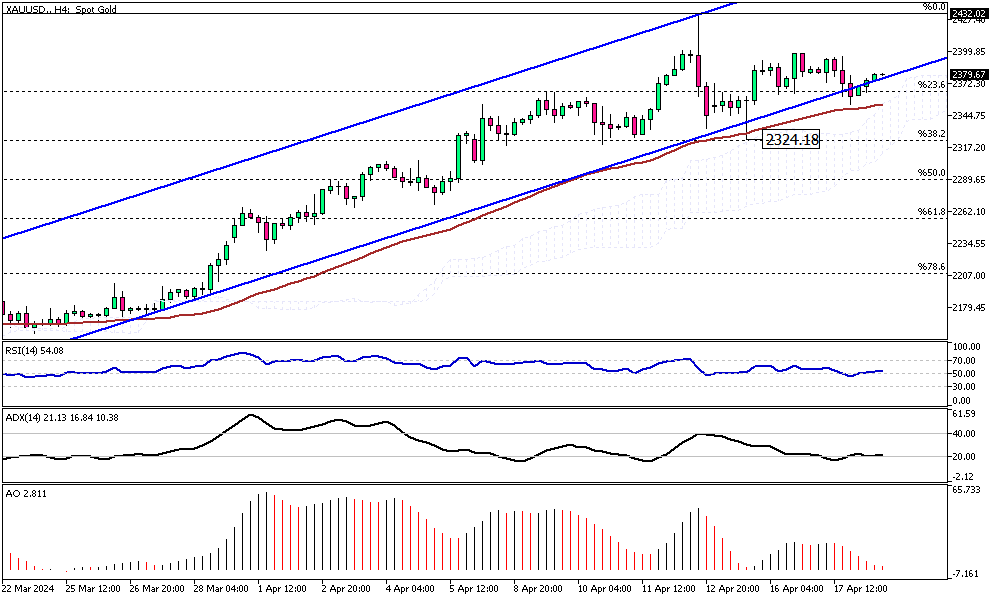

Gold prices slipped to near $2,370 per ounce on Thursday, reversing from recent record highs. The drop comes as Federal Reserve officials adopt a firmer stance, suggesting that interest rates may remain high for an extended period. This outlook is driven by ongoing inflation concerns and strong labor market conditions, reinforcing Fed Chair Jerome Powell’s remarks that the current restrictive monetary policy needs more time to take effect.

Gold Retreats Amid Rising Interest Rates

Higher interest rates reduce the attractiveness of gold, which does not yield interest. However, despite the pressure from rising rates, gold continues to find support. Geopolitical tensions, mainly due to the conflict in the Middle East and fears of it spreading, along with significant purchases by central banks, have sustained demand for gold as a safe-haven asset.

As the global economic and political landscape remains uncertain, gold’s dual role as a safe investment and a hedge against inflation keep its prospects buoyant, even against the backdrop of potentially prolonged high-interest rates.