Gold Declines as US Business Activity Rises

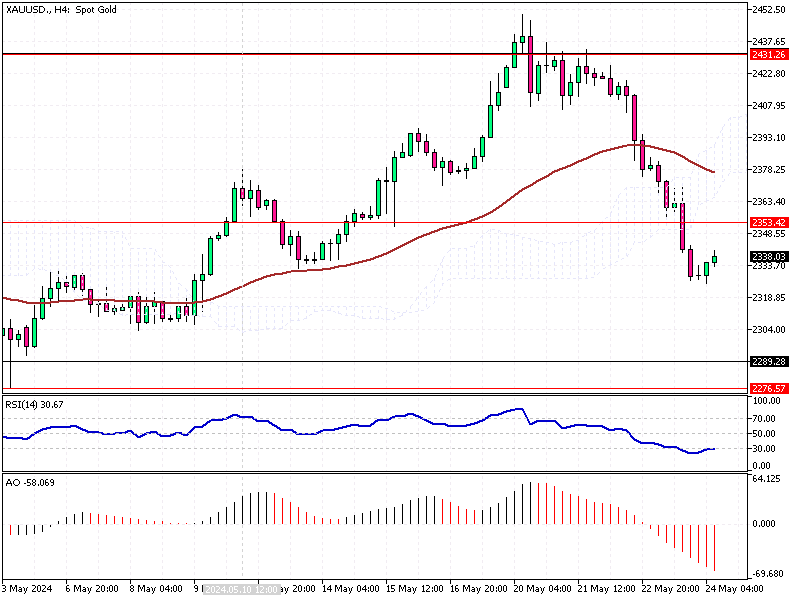

Gold Analysis—The yellow metal dropped to around $2,338 per ounce on Friday, nearing two-week lows. This marks the first weekly decline in three weeks. According to recent US economic data, investors are adjusting their expectations regarding Fed rate cuts.

On Thursday, S&P Global released its May flash readings for the manufacturing, services, and composite PMIs. These showed that US business activity is accelerating. This positive economic data impacts investor sentiment and gold prices.

Gold Declines as US Business Activity Rises

The number of Americans filing unemployment claims was less than expected, indicating a strong labor market. This further reduces the likelihood of imminent rate cuts by the Federal Reserve.

The Fed’s May meeting minutes revealed ongoing concerns about persistent inflation. Several officials indicated a willingness to raise interest rates if price growth continues. This sentiment is contributing to gold’s decline.

Overall, gold is set to decline by 3.4% this week. Investors should stay informed about economic data and Fed policies to make better trading decisions.