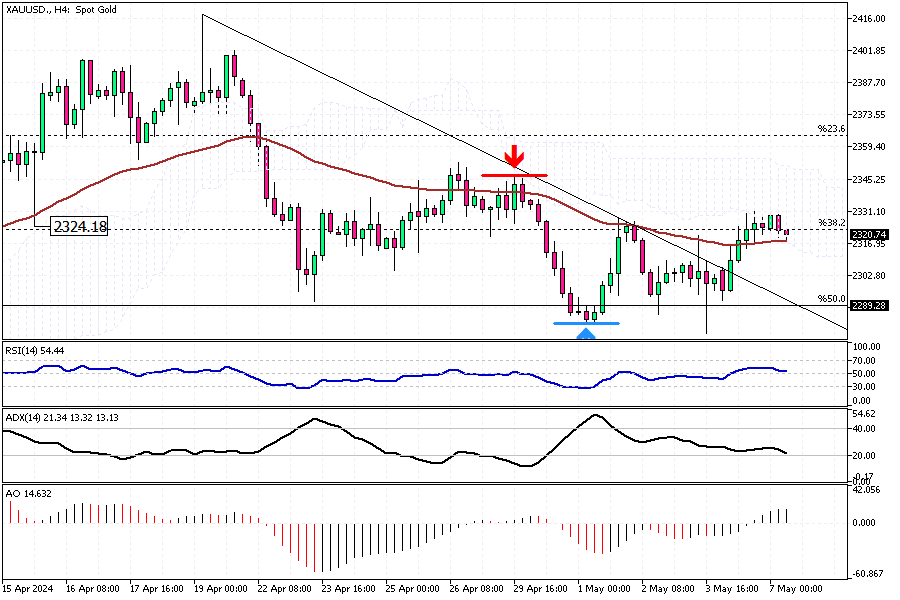

Gold Analysis – Prices Spike Over $2320

Gold prices have surged to a new high, reaching over $2,320 per ounce this Tuesday. The increase is largely driven by the anticipation that the Federal Reserve might reduce interest rates following recent disappointing job growth figures in the U.S. This speculation was further fueled by comments from Fed officials, suggesting a potential for rate cuts later in the year.

The dovish remarks made by Fed Chair Powell last week were particularly impactful. According to the CME’s FedWatch Tool, investors are now pricing in a 64% chance of a rate cut by September.

Gold Analysis – Prices Spike Over $2320

The possibility of lower interest rates is key to understanding the recent rise in gold prices. When rates decrease, the cost of holding non-yielding assets like gold becomes more attractive. This dynamic is a crucial element for forex traders and investors to consider, as it directly affects gold’s appeal as an investment during periods of economic adjustment.

Geopolitical Influence

In addition to economic indicators, geopolitical developments also play a significant role in the gold market. Current events in the Middle East, particularly concerning the conflict involving Hamas and Israel, are on investors’ radar.

Despite Hamas accepting a ceasefire proposal in Gaza, Israel has continued its military activities in Rafah, expressing dissatisfaction with the ceasefire terms and seeking further negotiations. These tensions contribute to market uncertainty, often increasing the safe-haven appeal of gold.