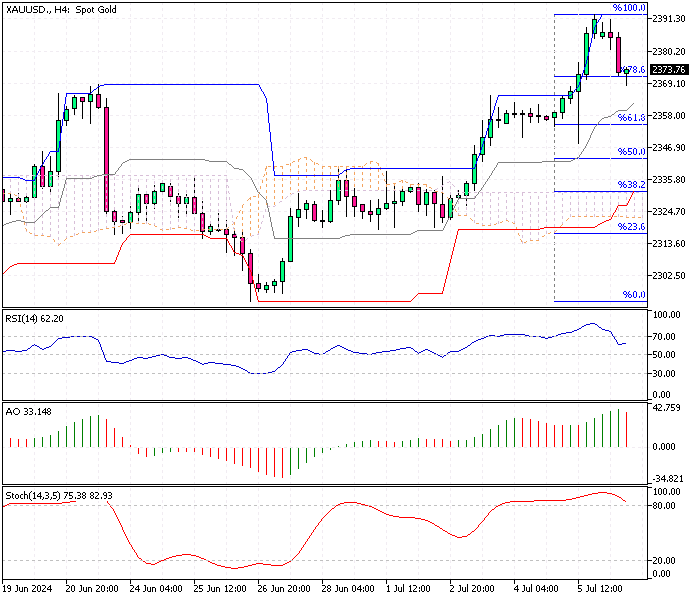

Gold Analysis 8-July-2024

Gold prices dipped below $2,390 per ounce on Monday after a more than 1% increase in the previous session. Despite this drop, gold remains near six-week highs due to rising expectations of early rate cuts by the Federal Reserve following weak US economic data.

Gold Analysis 8-July-2024

On Friday, data showed a softening US labor market, with unemployment reaching a two-and-a-half-year high and wage growth hitting a three-year low. Currently, markets are predicting a 78% chance that the Fed will start cutting rates in September, with hopes for a second rate cut by the end of the year.

This week, investors focus on the upcoming US CPI and PPI releases and Fed Chair Powell’s semi-annual testimony on monetary policy before Congress. Additional remarks from Fed officials are also expected.

In Europe, traders watch political developments after France’s left-wing New Popular Front coalition unexpectedly blocked a far-right advance on Sunday but did not secure a majority.