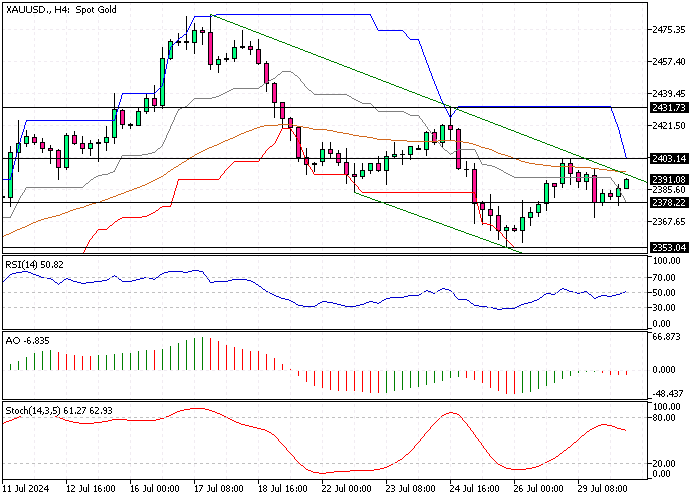

Gold Analysis 30-July-2024

Gold prices climbed to nearly $2,390 per ounce on Tuesday after experiencing some losses the day before. This increase comes as investors eagerly anticipate upcoming meetings from major central banks this week.

Gold Analysis 30-July-2024

The Federal Reserve is expected to maintain current interest rates on Wednesday. However, investors are keenly watching for any signs that a rate cut might happen in September. The Bank of Japan, on the other hand, is likely to raise its rates by ten basis points, bringing them to 0.1%.

There’s uncertainty around the Bank of England’s decision, as opinions vary on whether it will start lowering borrowing costs. Traders are also gearing up to analyze important US economic data this week.

A key focus will be on the non-farm payrolls report. The US economy is anticipated to add 185,000 jobs this month, a decrease from the 206,000 jobs added in June. The unemployment rate is expected to stay at 4.1%, the same level as in 2021. Additionally, wage growth is projected to be 0.3%.

For those new to these terms, “non-farm payrolls” refer to the number of new jobs added, excluding farm workers, government employees, private household employees, and employees of nonprofit organizations. This data is a vital indicator of the health of the economy.

The unemployment rate represents the percentage of the labor force that is unemployed and actively seeking work, and wage growth indicates how much workers’ earnings are increasing over time. All these factors combined give a clearer picture of the economic landscape and help investors make informed decisions.