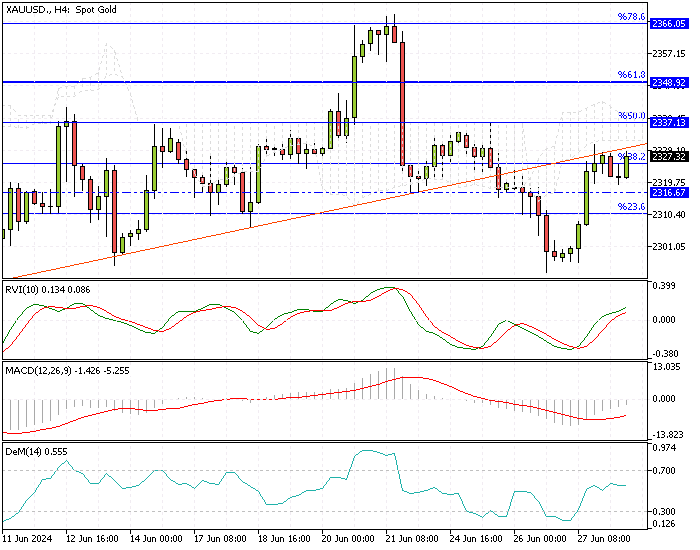

Gold Analysis – 27-June-2024

Gold prices dipped to about $2,320 per ounce on Friday after gaining over 1% the day before. Investors were cautious as they awaited key US inflation data, looking for hints about the Federal Reserve’s policy plans. The Fed’s preferred inflation measure, the annual PCE inflation, is expected to drop from 2.7% to 2.6%, and the core PCE from 2.8% to 2.6%.

Gold Analysis – 27-June-2024

US Economy Slows as Job Market Weakens

Meanwhile, yesterday’s data showed the US economy slowing down. Wholesale inventories were lower than expected, the final GDP figure was significantly cut, and unemployment claims hit their highest level since late 2021, pointing to a weakening job market.

These results matched market expectations that the Fed will start cutting rates in September, with another cut expected later in the year. Gold is set to drop for the first time in five months for the month, but it is on track for a quarterly increase.