Geopolitical Tensions Support Gold Demand

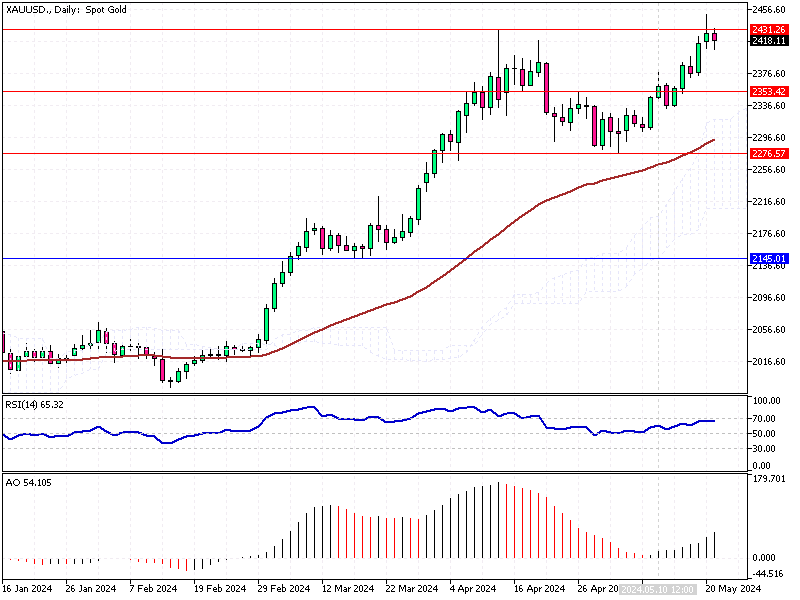

On Tuesday, gold prices fell around $2,410 an ounce, retreating from record highs. This decline came after recent remarks from Federal Reserve officials. Despite cooling US consumer inflation data last week, Fed officials are cautious. They are not ready to declare that inflation is approaching the central bank’s target. Several officials recommend continued policy caution.

Vice Chair’s Emphasis on Policy Evaluation

Fed Vice Chair Michael Barr stressed the need for more time to evaluate the effectiveness of restrictive policies. His comments suggest the Fed is not hurrying to change its current stance. Traders will closely watch for more insights from other Fed officials scheduled to speak throughout the week. Their comments could provide further direction on the future of monetary policy.

Geopolitical Tensions Support Gold Demand

Despite the drop in gold prices, strong safe-haven demand continues to support the metal. This demand is driven by fears of a potential escalation in geopolitical tensions, especially after the death of Iranian President Ebrahim Raisi. Investors often turn to gold during political uncertainty, seeking a safe investment.

Central Bank Purchases Bolster Gold

Additionally, robust central bank purchases, particularly by China, bolster gold prices. China is buying gold to reduce its reliance on the US dollar. This trend of central bank purchases supports the overall demand for gold, contributing to its price stability despite fluctuations influenced by other factors.