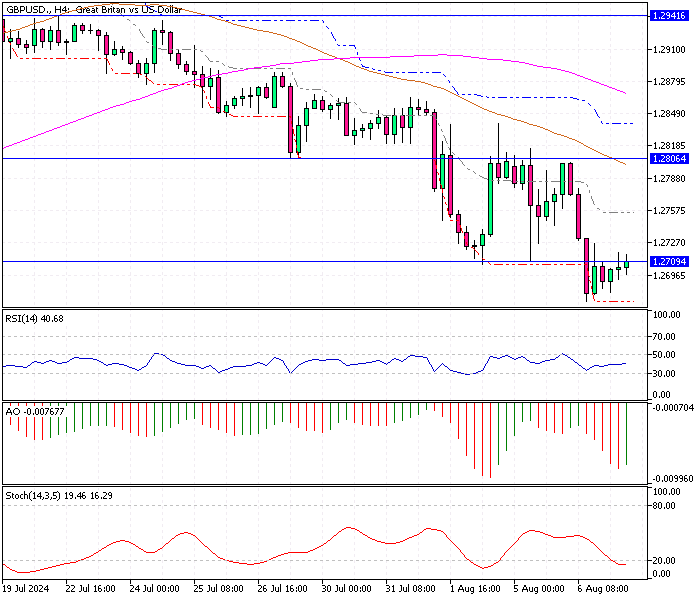

GBPUSD Analysis 7-August-2024

The British pound dropped to $1.27 (GBP/USD), nearing a one-month low, as investors expect quicker interest rate reductions from the Bank of England. This decline is happening alongside fears of a US recession, pushing British government bond yields to their lowest levels in several months. The market now predicts two quarter-point rate cuts from the BoE by December.

GBPUSD Analysis 7-August-2024

On Monday, interest rate futures showed an expected total of 56 basis points of cuts this year, up from 47 basis points anticipated on Friday. Additionally, two-year gilt yields, which indicate changes in borrowing costs, decreased by 8 basis points to 3.526%, the lowest since April 2023. Last week, the BoE reduced its primary interest rate from 5.25%, a 16-year high, to 5.0%, marking the first cut since 2020.