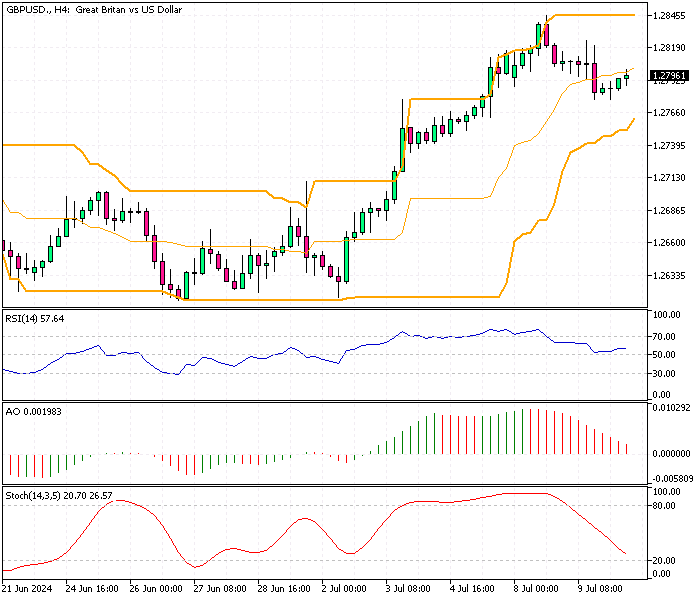

GBPUSD Analysis 10-July-2024

The British pound dropped to $1.278 from a nearly four-month high of $1.281 after Fed Chair Powell spoke cautiously about rate cuts in Congress. Powell stressed the importance of seeing clear signs of inflation hitting the 2% target before cutting rates. He warned against delaying or not reducing policy restraint enough.

In the UK, investors are expecting a rate cut in August. This follows the Bank of England’s choice to keep rates steady, even with 2% inflation. Attention now turns to upcoming economic data, like US CPI and UK GDP numbers, for clues on future rate decisions.

Additionally, the Labour Party’s win in the parliamentary election, ending the Conservative Party’s 14-year rule, is seen as boosting the UK’s image as a safe haven amid global political uncertainties.

GBPUSD Analysis 10-July-2024