GBPJPY Technical Analysis: JPY Market on the Rise

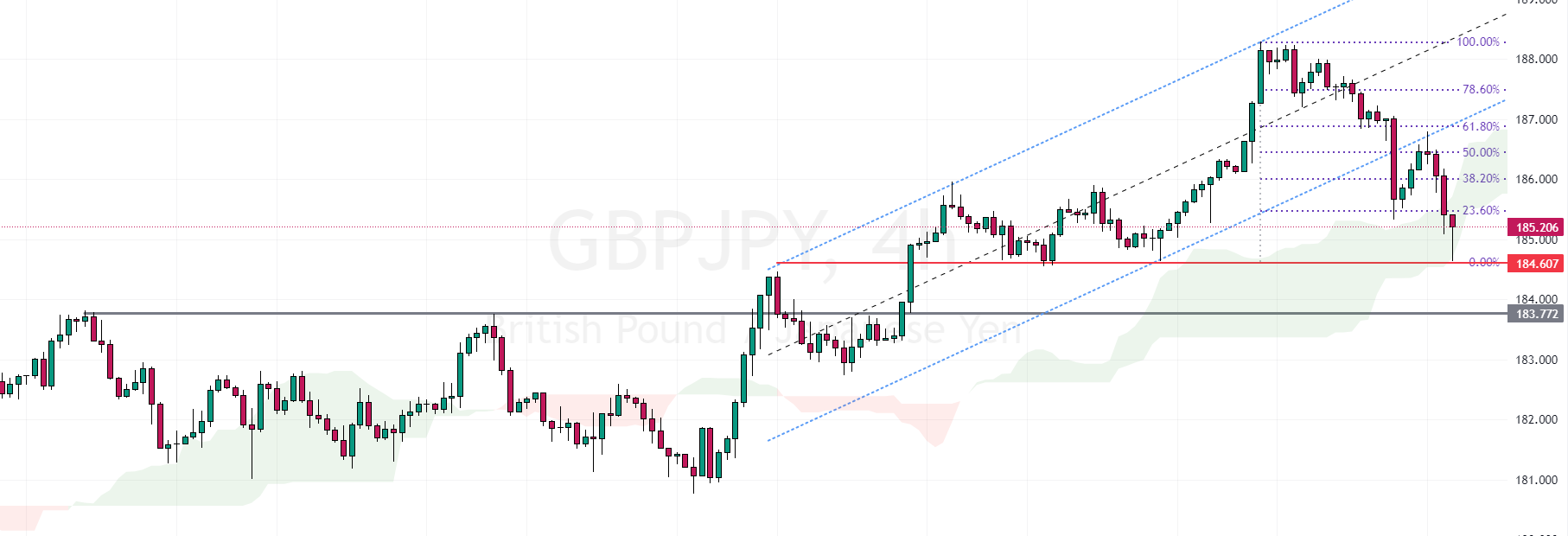

The GBPJPY currency pair is currently testing the S1 support at 184.89. This level’s significance is heightened by its alignment with the Ichimoku cloud, reinforcing the support’s strength. With the GBPJPY having dipped below the previously broken bullish flag, the market’s short-term direction is leaning bearish. For the bearish momentum to attract more sellers, the price needs to close and consistently remain below the cloud.

On the other hand, if the GBPJPY pair sustains itself above the 184.6 level, a market correction phase might be imminent. In such a scenario, we can anticipate the market testing the 38.2% Fibonacci level, potentially extending to the 50% level thereafter.

Understanding the Dynamics of Japanese Stock Market

Reuters — Recently, the Nikkei225 Index, a key indicator of the Japanese stock market, saw a significant rise, climbing by 0.8% to reach a notable 33-year high at 33,853. This was a moment of excitement for investors as it marked a peak not seen in over three decades. However, this high was short-lived. By the end of trading on Monday, the Index had dropped by 0.59%, settling at 33,388. This decline was largely due to investors deciding to take profits after a sustained three-week period of growth in the market.

Similarly, the Topix Index, which represents a broader range of stocks, also experienced a decline, falling by 0.77% to end at 2,373. These movements in the stock market are significant as they reflect the overall economic health and investor confidence in Japan.

Factors Influencing the Japanese Stock Market

The recent increase in stock prices was primarily fueled by strong earnings reports from within Japan. Additionally, there was growing optimism among investors that the peak of U.S. interest rates had been reached, with expectations that these rates might start to decrease in the following year. Such expectations can have a substantial impact on global markets, including Japan.

Investors are now turning their attention to upcoming economic indicators and policy announcements. Key among these are the minutes from the latest Federal Reserve policy meeting, which could provide insights into future interest rate decisions. Also, upcoming manufacturing and service industry data, along with inflation figures from Japan, will be crucial in assessing the country’s economic condition.

Impact on Major Japanese Companies

This shift in the market has affected several major Japanese companies. Notably, Toyota Motor saw its shares drop by 3.9%, while Renesas Electronics experienced a 2.7% decline. Other significant companies like Disco Corp, Advantest, and Mitsubishi Corp also reported losses ranging from 1.1% to 1.6%.