EURUSD Technical Analysis:

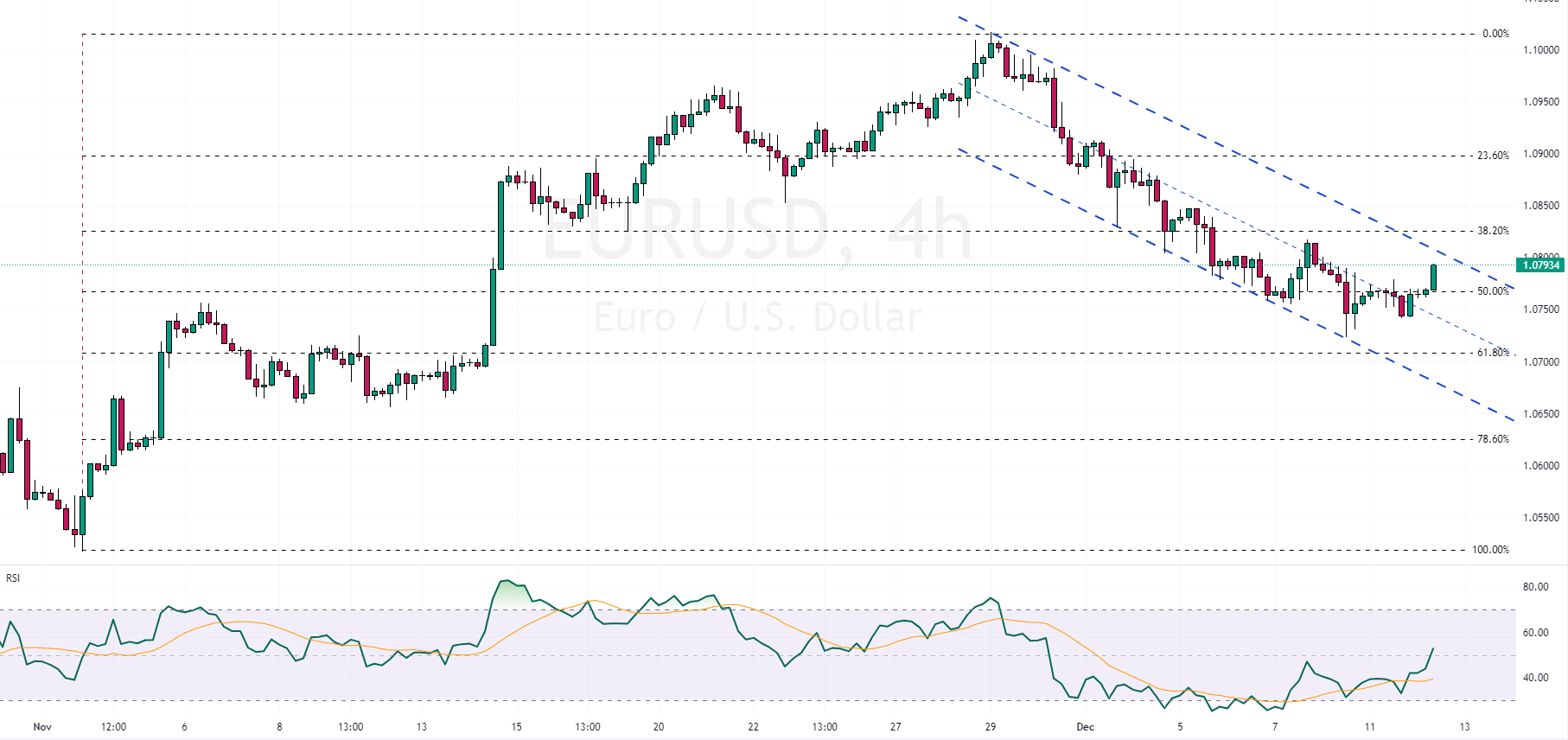

EURUSD Technical Analysis – The currency pair showed significant activity in the recent trading session. This pair, representing the value of the Euro against the US Dollar, has risen above an important threshold, known as the 50% level of the Fibonacci retracement tool. This tool is used by traders to predict possible future exchange rate levels based on past trends.

At the same time, another indicator, the Relative Strength Index (RSI), has moved above its middle line. This movement typically suggests a bullish trend, meaning the value of the Euro is strengthening against the Dollar. However, despite these indicators, the overall movement of the EURUSD pair still suggests a bearish trend, which means the Euro is generally weakening against the Dollar.

For traders hoping for a bullish trend, there’s a specific condition that needs to be met. The price must stabilize above the upper band of what’s called the “flag pattern” in trading. This flag pattern is a technical analysis tool that helps traders predict future market movements. If the price can remain above this upper band, it may signal a sustained increase in the Euro’s value against the Dollar.

European Stocks Rise Ahead of US Inflation

Bloomberg – On Tuesday, European stock markets saw modest gains. The STOXX 50 reached a new 16-year high, and the STOXX 600 climbed to its highest point in almost two years. This uptick comes as investors await the latest US inflation data and prepare for key interest rate decisions from major central banks, including the ECB, BoE, and US Fed. These institutions are expected to keep rates at their current multi-year highs, with the investment community keenly watching for any signs of potential rate cuts next year.

Amid these expectations, a recent UK jobs report revealed a larger-than-expected drop in wage growth. On the corporate front, there were mixed developments. Carl Zeiss shared positive results, contrasting with Nokia, which lowered its profitability expectations after a lost deal with a US telecom company. In the pharmaceutical sector, AstraZeneca announced its plan to purchase US vaccine maker Icosavax in a deal that could reach $1.1 billion. Meanwhile, Sanofi ended an exclusive licensing agreement with Maze Therapeutics for a Pompe disease treatment.