EURUSD Bullish Run: A Look at Upcoming Trends

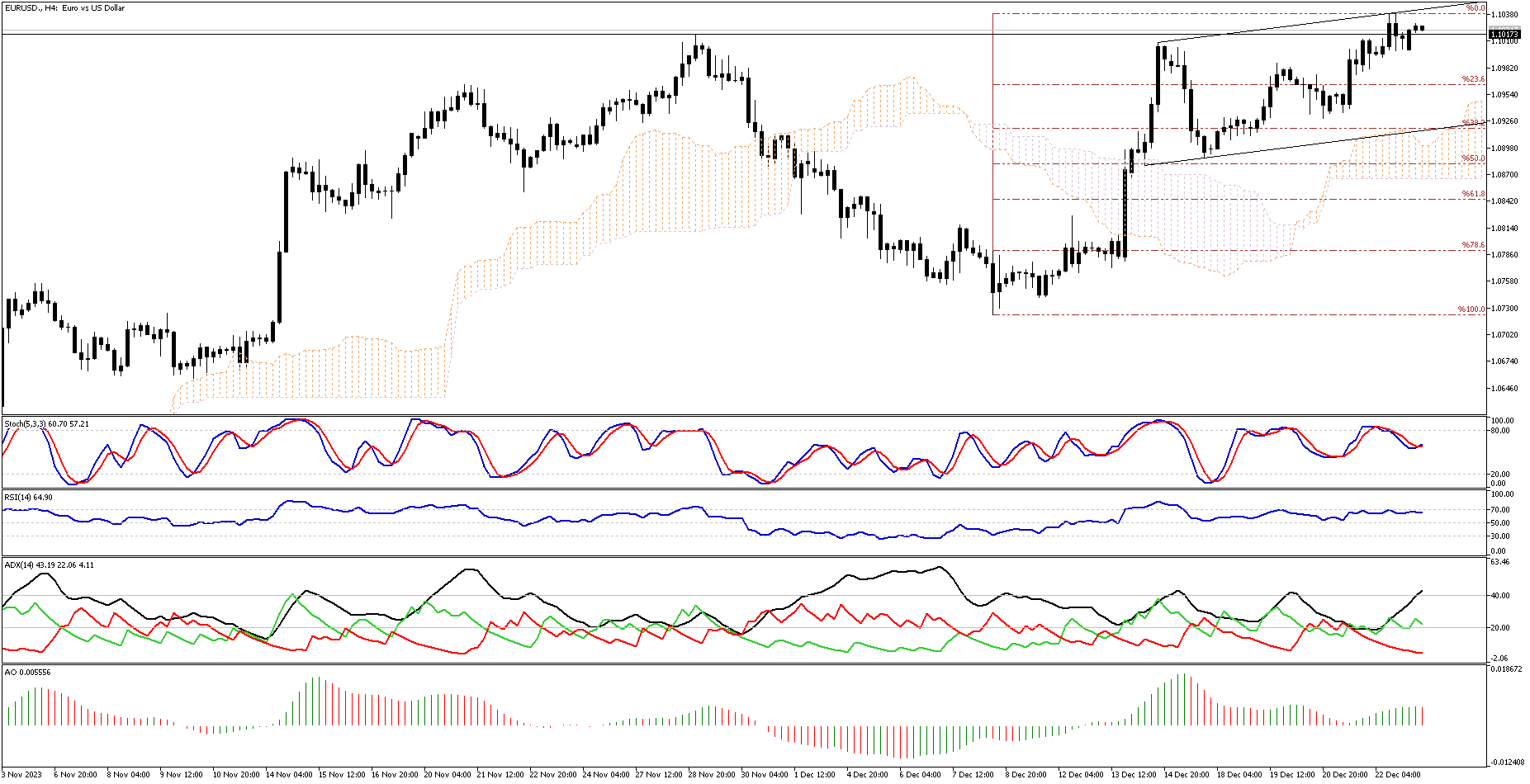

On Tuesday, the EURUSD pair saw a positive start, trading just above its November high of 1.1017. This uptrend is fueled by the market’s positive outlook, largely due to expectations of U.S. Federal Reserve rate cuts in 2024. However, a closer look at the momentum indicators suggests that the EURUSD is currently in an overbought condition. This is evident from the RSI nearing the 70 level and the Awesome Oscillator indicating divergence.

The technical analysis, particularly from the EURUSD 4-hour chart, hints that the pair might soon enter a consolidation phase. During this period, there’s a possibility that the price might drop to the 23.6% Fibonacci support level, and possibly even to the 38.2% level thereafter. For traders looking to capitalize on the bullish market, these two Fibonacci levels could offer a favorable opportunity to plan their entry.