EURUSD Analysis – ECB Expected to Cut Rates

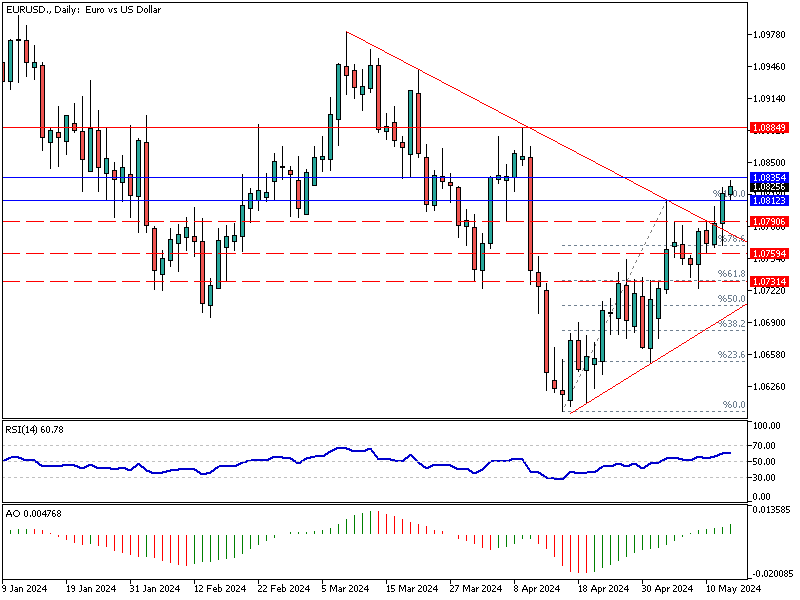

The Euro has continued its upward trend, recently surpassing $1.080 (EURUSD), marking its highest level in five weeks. This rise is largely due to investors adjusting their expectations for interest rate cuts by major central banks.

ECB Expected to Cut Rates

Bloomberg – The European Central Bank (ECB) is expected to cut rates in their upcoming meeting on June 6. Market forecasts suggest a potential decrease of approximately 70 basis points over the year. This anticipated cut is driving the Euro’s current strength.

In contrast, the Federal Reserve is not expected to lower borrowing costs until September or November. This delay is due to recent data showing producer prices rose more than expected in April. The Fed’s more cautious approach impacts the USD, making the Euro more attractive to investors.

Key Data Releases Ahead

Investors are now eagerly awaiting several key data points. The US consumer price index report and the first-quarter GDP and employment data for the Euro Area will be released on Wednesday. These reports will provide further insight and likely influence future trading decisions.