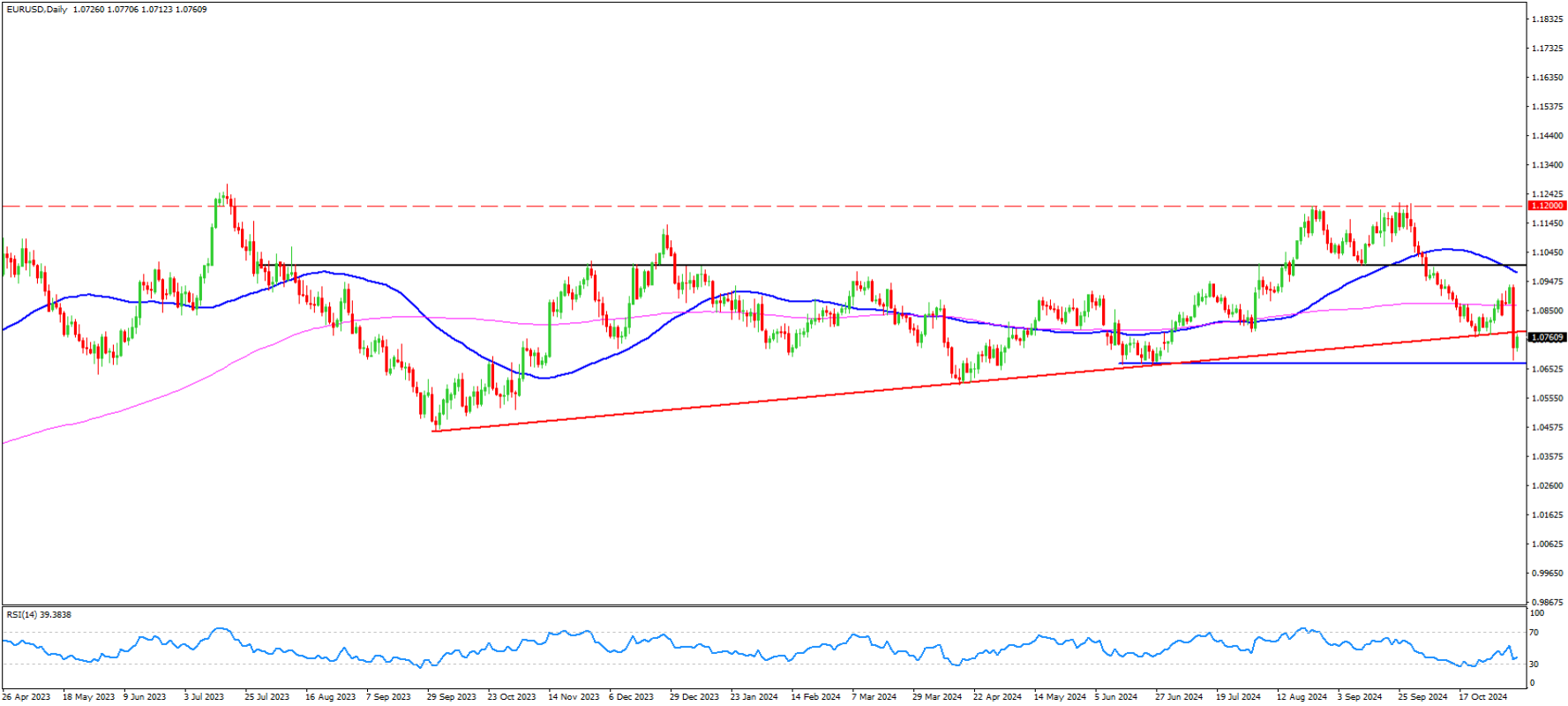

EURUSD Analysis 7-November-2024

Following Trump’s election as president in the US elections, we observed sharp increases in the dollar index. In this context, the EURUSD parity experienced its sharpest decline since 2016 yesterday.The difficulties experienced in Europe are increasing the weakness in the EUR.We will follow the Fed meeting today. The Fed is expected to lower interest rates by 25bps. The messages given by Fed Chair Powell will be important.Technically, as long as the 1.0770 band is not exceeded in the short term and the 1.09/1.10 band in the broader picture, we expect the direction to remain down and the increases to provide a selling opportunity.If 1.0680 is broken below, 1.06 can be targeted.