EURUSD Analysis – 17-June-2024

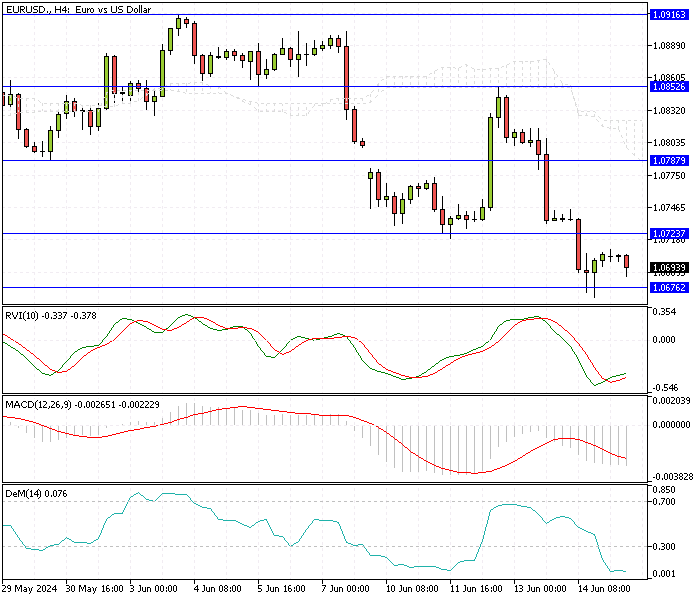

The EUR/USD pair is currently at a pivotal point, testing the crucial support level of $1.067. Historically, This significant level has been a strong foundation, preventing further declines. However, the market sentiment, as indicated by the Demarker indicator, shows that the market is deeply oversold.

This suggests that the selling pressure might be excessive, and a reversal could be on the horizon.

EURUSD Analysis – 17-June-2024

EURUSD Analysis – 17-June-2024

A closer look at the 4-hour chart reveals a pattern of uncertainty. The appearance of shooting star candlesticks three times indicates a potential bearish reversal, reflecting market hesitation. Traders should watch the $1.072 resistance level closely.

If the EUR/USD price breaks through this barrier, it could signify the start of a rebound, with the next target set at $1.078. The Ichimoku cloud, a reliable technical analysis tool, supports this potential upward movement, providing additional confirmation.

EUR/USD Bearish Scenario

However, the downside risk remains if the bears succeed in pushing the price below the $1.067 support level. In this scenario, the downtrend will likely continue, possibly leading to further declines.

Summary

Investors should monitor these key levels and market signals to make informed trading decisions. The current oversold condition and critical support and resistance levels create a landscape of risk and opportunity.