Euro Faces Pressure Amid Divergent Central Bank Policies

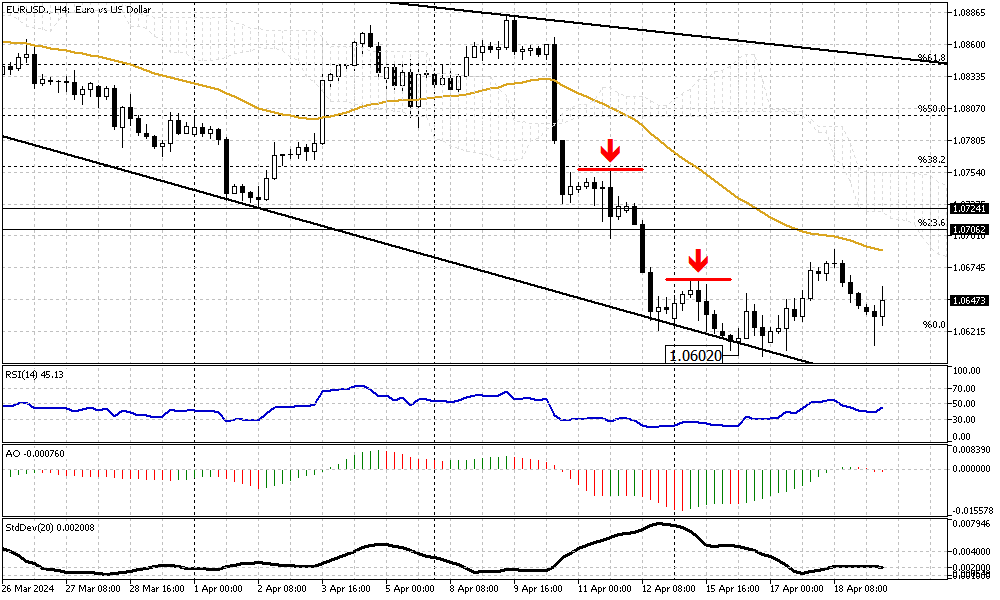

EURUSD Analysis – The euro is trading close to $1.065, its lowest position in the past five months. This downturn is influenced by the differing approaches of two major central banks: the European Central Bank (ECB) and the Federal Reserve (Fed) in the United States.

On one side, ECB President Christine Lagarde announced Tuesday that the bank plans to cut interest rates soon. She noted that recent geopolitical events have not significantly affected commodity prices, often influencing inflation and monetary policy. Investors expect the ECB to initiate its first rate cut as early as June, with two additional reductions anticipated before 2024.

Fed’s Powell Signals Delay in Rate Cuts Until Late 2024

Conversely, the Fed, led by Chair Jerome Powell, presented a different outlook. Powell indicated on the same Tuesday that the U.S. might delay any reduction in interest rates due to current inflation trends. According to Powell, the inflation data suggests that the Fed needs more time to assess the economic situation before feeling comfortable with lowering rates. This hesitancy indicates that any potential rate cuts by the Fed might not occur until late 2024.

Central Banks’ Clash Shakes Euro Stability

These contrasting strategies between the ECB and the Fed are causing uncertainty in the currency markets, particularly affecting the euro. The ECB’s imminent rate cuts are intended to stimulate economic growth by making borrowing cheaper, which typically weakens a currency. Meanwhile, the Fed’s cautious stance on rate adjustments reflects ongoing concerns about inflation, which can strengthen a currency by maintaining higher interest rates.

As a result, the euro remains under pressure as traders and investors navigate these divergent signals from two of the world’s most influential central banks.