Canadian Dollar Drops Amid US Strength and Policy Plans

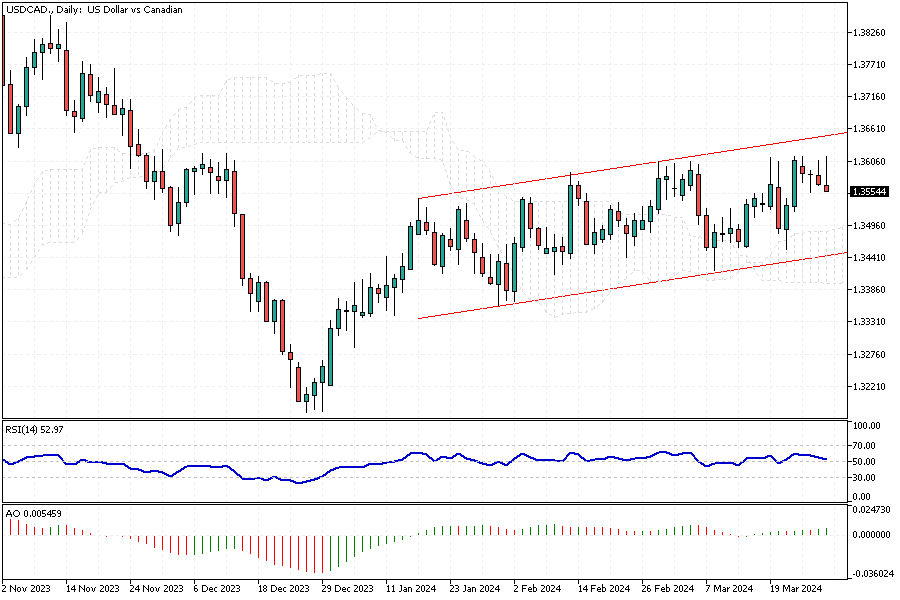

USDCAD Analysis – In March, the Canadian dollar fell below 1.36 against the US dollar, reaching its lowest in almost four months. This was due to strong economic figures from the US, suggesting the Federal Reserve might keep up its tight policy.

Also, more cautious approaches from key European central banks made the US dollar more attractive. The situation was further pushed by the Swiss National Bank cutting its rates unexpectedly by 25 basis points, along with a cautious move by the Bank of England, which led to more investors buying the US dollar.

Meanwhile, in Canada, a slight growth in retail sales by 0.1% was noted in February 2024, an improvement from a 0.3% fall in January. Additionally, Deputy Governor Toni Gravelle of Canada mentioned the bank’s aim to end its quantitative tightening by 2025, focusing on its feasibility with slow interest rate cuts. The Bank of Canada’s Governing Council also noted the possibility of lowering rates in 2024 based on the economic situation. However, there’s still debate about when to do so and concerns over inflation.