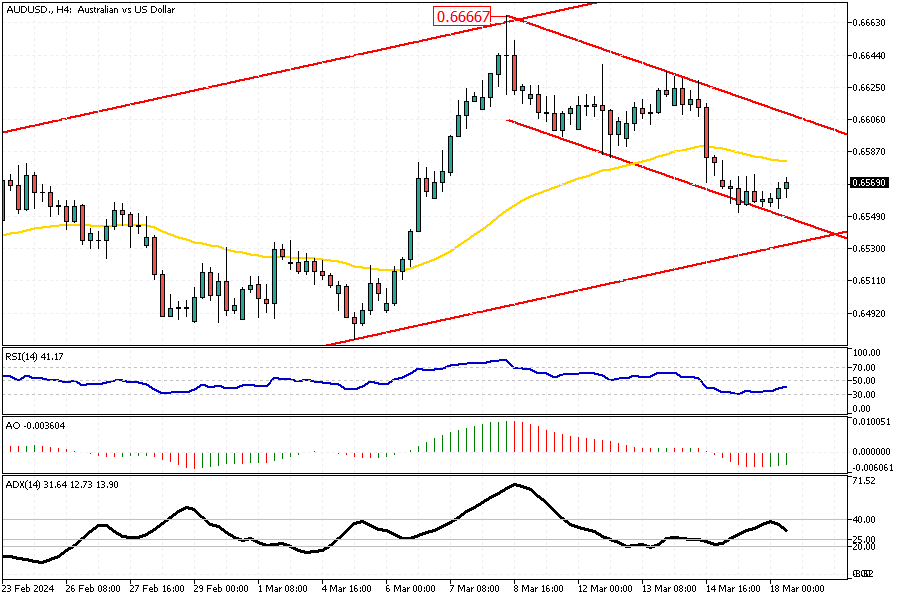

AUDUSD Analysis – March-18-2024

AUDUSD Analysis – The Australian dollar has declined, reaching a low not seen in more than a week, with values plummeting to around $0.655. This drop is primarily due to the unexpected rise in US inflation rates, which has cast doubt on when and by how much the Federal Reserve will reduce interest rates this year.

The higher-than-anticipated inflation figures in the US for February have led investors to rethink their expectations, particularly regarding a potential rate cut by the US central bank in June.

Economic Headwinds: Challenges in Australia’s Economy

On the home front, recent figures have not been up-and-coming for Australia, revealing slower economic growth than forecast for the last quarter. This underperformance has fueled speculation among traders that the Reserve Bank of Australia (RBA) might begin to lower interest rates within the year to counteract sluggish economic momentum.

The softening economic indicators suggest that the central bank might adopt a more accommodative policy stance to support the economy.

Rate Cut Speculations: Market Predictions

Market sentiment reflects a cautious outlook, with a 70% likelihood being assigned to the RBA initiating a cut in the cash rate by August. Investors are bracing for a total reduction of 40 basis points in rates over the year. These adjustments are anticipated in response to Australia’s internal and external economic pressures, highlighting the intertwined nature of global and domestic financial conditions.

The speculation around these rate cuts illustrates the broader economic challenges and strategic responses under consideration by Australia’s policymakers.