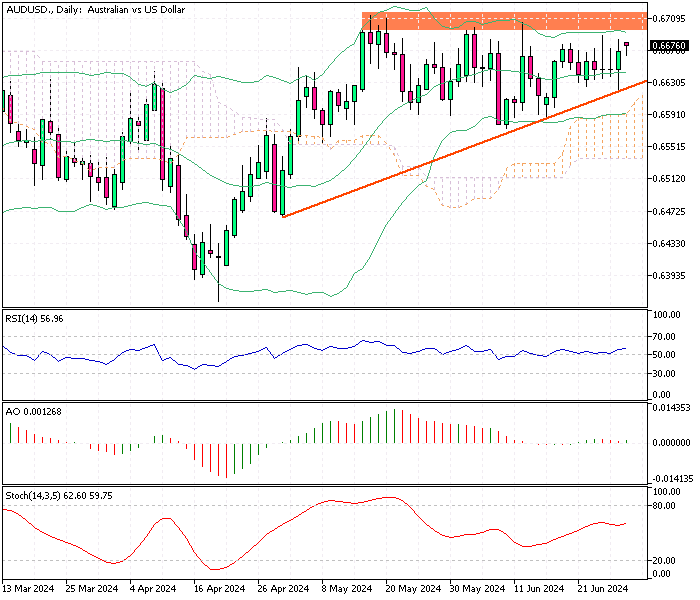

AUDUSD Analysis – 1-July-2024

AUD/USD—The Australian dollar remained steady around $0.667, close to its two-week high, as the US dollar weakened due to data showing lower US inflation in May. This strengthened the belief that the Federal Reserve might cut interest rates this year.

In Australia, updated figures revealed that June’s manufacturing activity dropped significantly, marking the biggest fall since May 2020, mainly due to a sharp drop in new orders.

AUDUSD Analysis – 1-July-2024

Australia’s CPI Spike Sparks Rate Hike Talks

Additionally, last week’s data indicated that Australia’s annual CPI increased by 4% in May, up from 3.6% in April, surpassing the expected 3.8%. As a result, the likelihood of a Reserve Bank of Australia rate hike in August grew, while the chances of a rate cut this year diminished.

However, RBA Deputy Governor Andrew Hauser cautioned against basing policies on a single inflation reading, noting that the complete second-quarter inflation report, expected at the end of July, will offer more insight.