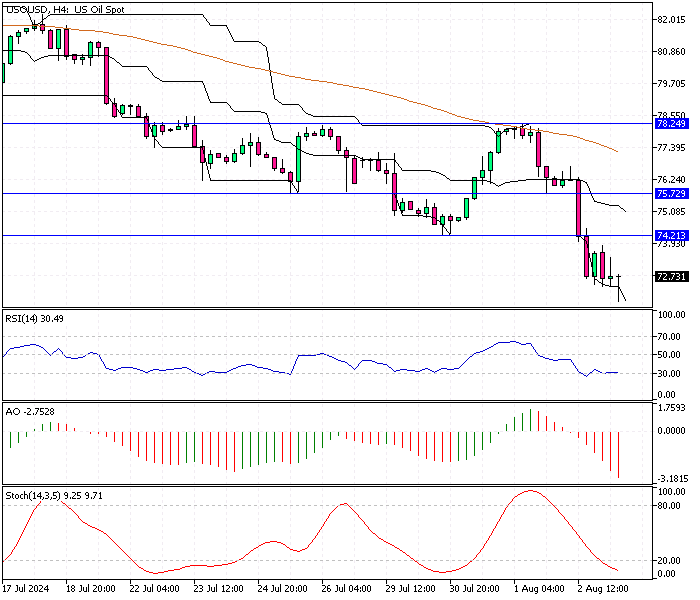

Crude Oil Analysis 5-August-2024

WTI crude oil futures dropped to around $73 per barrel on Monday, marking the third consecutive session of decline. This decrease is mainly due to growing concerns about a potential recession in the United States, the largest global oil consumer.

These recession fears are overshadowing the supply risks linked to geopolitical tensions in the Middle East.

Crude Oil Analysis 5-August-2024

Recent data released on Friday indicated several troubling economic trends in the US. There was a significant slowdown in job growth, an increase in the unemployment rate, and slower wage growth.

Additionally, the manufacturing sector showed signs of weakness. The ISM Manufacturing PMI, an essential indicator of manufacturing health, revealed a bigger-than-expected decline in factory activity.

Adding to the concerns, China’s manufacturing sector also saw an unexpected downturn, marking its first decline since October of the previous year. This unexpected contraction in China, a major global economy, has heightened fears about reduced oil demand.

In the Middle East, the situation remains tense. Reports emerged that an Israeli airstrike on Sunday targeted two schools, resulting in at least 30 fatalities. Furthermore, the market is closely monitoring Iran’s potential reaction after it pledged to retaliate for the assassination of Hamas leader Ismail Haniyeh. This follows the killing of a top Hezbollah commander in a Beirut airstrike.

Overall, these developments contribute to a volatile environment for oil prices, with economic concerns in major economies like the US and China being balanced against geopolitical risks in the Middle East.

For new investors or those less familiar with the oil market, it is essential to understand that a mix of economic data, geopolitical events, and market sentiment influences oil prices. Monitoring these factors can provide insights into future price movements.