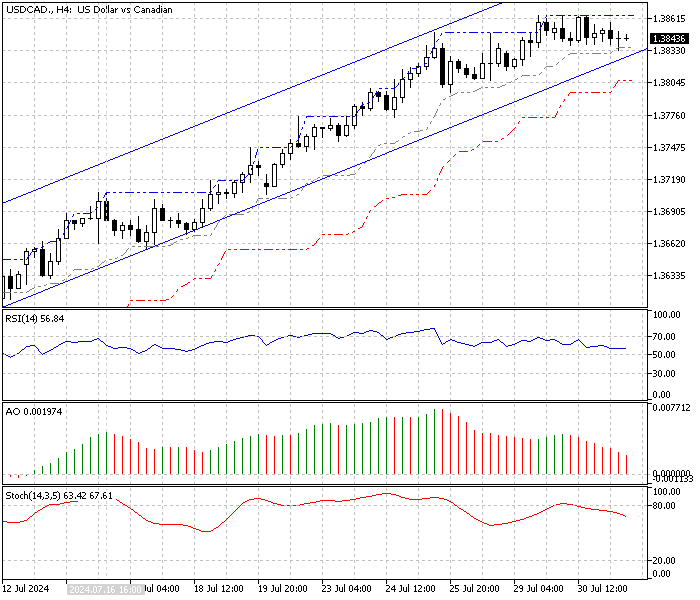

USDCAD Analysis 31-July-2024

In July, the Canadian dollar dropped to $1.384 (USD/CAD), marking its lowest point in fourteen weeks. This decline followed the Bank of Canada’s latest decision on interest rates. The Bank of Canada (BoC) decided to cut its key interest rate by 25 basis points, bringing it down to 4.5%.

USDCAD Analysis 31-July-2024

They chose this because of too much supply and a cooling job market. The goal is to lower inflation by reducing costs related to mortgages and housing. The BoC expects the Consumer Price Index (CPI) to settle at 2% by 2025.

This rate-cut decision substantially impacted the Canadian dollar more than the weakening US dollar. In the US, poor manufacturing data led investors to believe that the Federal Reserve might also reduce interest rates soon. This expectation added to the pressure on the Canadian dollar.

Interest rates are crucial for those new to this topic because they influence borrowing costs. When a central bank cuts rates, it generally aims to make borrowing cheaper, encouraging spending and investment.

However, lower rates can also lead to a weaker currency because they offer lower returns for investors. In this case, the BoC’s decision to cut rates was intended to ease financial pressures on households and help control inflation. These measures are expected to help stabilize the economy in the long term.