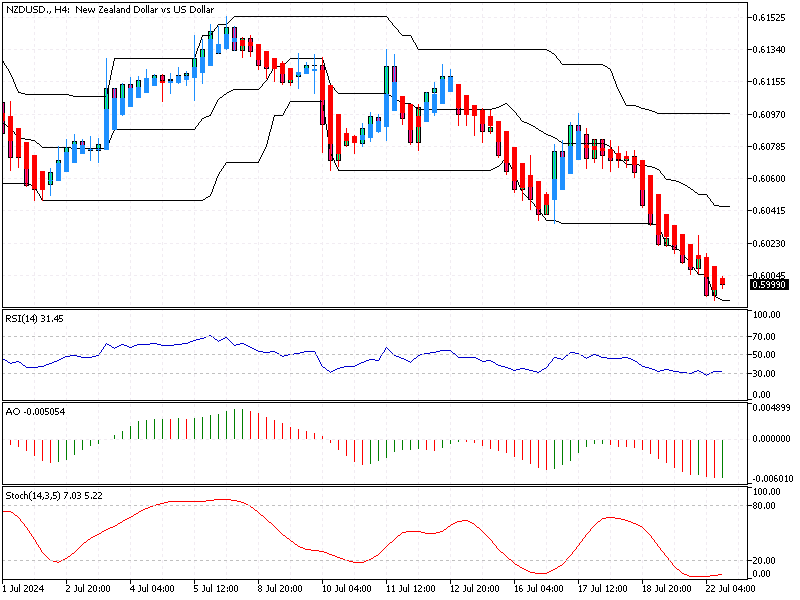

NZDUSD Analysis – 22-July-2024

The NZD/USD has dropped to $0.599, marking its lowest point over two months. This decline comes as investors react to US President Joe Biden’s decision to withdraw from the upcoming presidential race. Biden announced on Sunday that he will not seek reelection and has endorsed Vice President Kamala Harris as his successor.

NZDUSD Analysis – 22-July-2024

NZDUSD Analysis – 22-July-2024

In New Zealand, the Kiwi dollar has also been affected by the possibility of several interest rate cuts from the Reserve Bank of New Zealand (RBNZ) this year. These cuts could start as early as next month, following a weak inflation report for the second quarter. Earlier this month, the RBNZ kept the cash rate unchanged at 5.5% but hinted they might reduce rates if inflation continues to slow down as predicted.

According to economic data, New Zealand posted a trade surplus of NZ$699 million in June. This surplus was mainly due to a 13% decline in imports, a sharper decline than the slight 0.1% drop in exports.

For those new to these topics, here’s some background: When a country’s central bank cuts interest rates, it often leads to a weaker currency. Lower rates can make investments in that country’s currency less attractive to investors. In the case of New Zealand, the potential rate cuts are a response to slower inflation, meaning that prices for goods and services aren’t rising as quickly as before.

Trade surplus, on the other hand, occurs when a country exports more than it imports. In June, New Zealand saw a significant import drop, contributing to its trade surplus. This drop in imports means the government spent less on foreign goods, while its exports remained almost unchanged.

Understanding these economic indicators and decisions can help explain why currencies fluctuate and what impacts they might have on the economy overall.