Kiwi Dollar Slumps as Inflation Data Looms

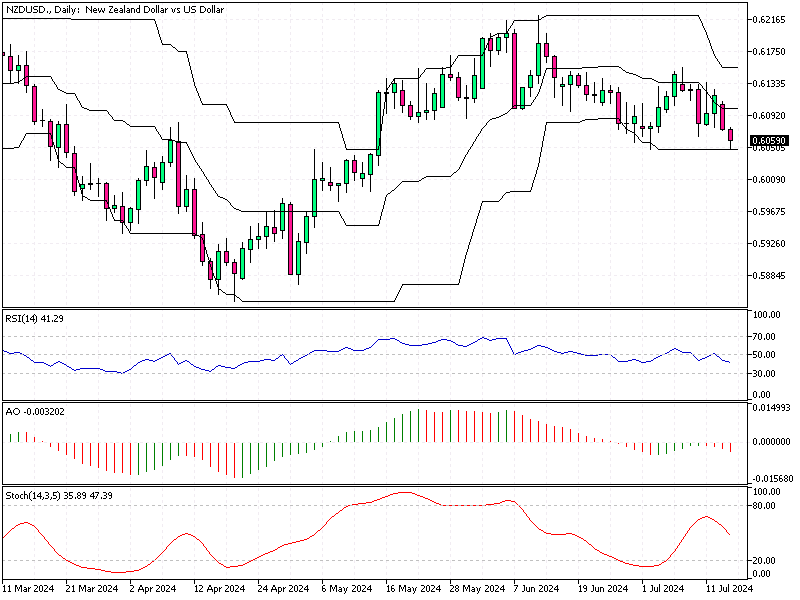

NZD/USD—The New Zealand dollar dropped to about $0.605, its lowest point in two weeks. Investors are waiting for the second-quarter inflation data, which could affect the Reserve Bank of New Zealand’s future policies.

Kiwi Dollar Slumps as Inflation Data Looms

Economists predict that consumer inflation in New Zealand has decreased to 3.5% in the second quarter, the lowest in three years, down from 4% in the first quarter. Recently, the RBNZ kept the cash rate at 5.5% but hinted that monetary policy might become less strict if inflation continues to fall as expected.

This has increased the chances of a rate cut in the August meeting, with the market now seeing a 53% likelihood of this happening. Additionally, the Kiwi is also facing pressure due to a slight rise in the US dollar, driven by increased safe-haven demand following an attempted assassination on former President Donald Trump over the weekend.