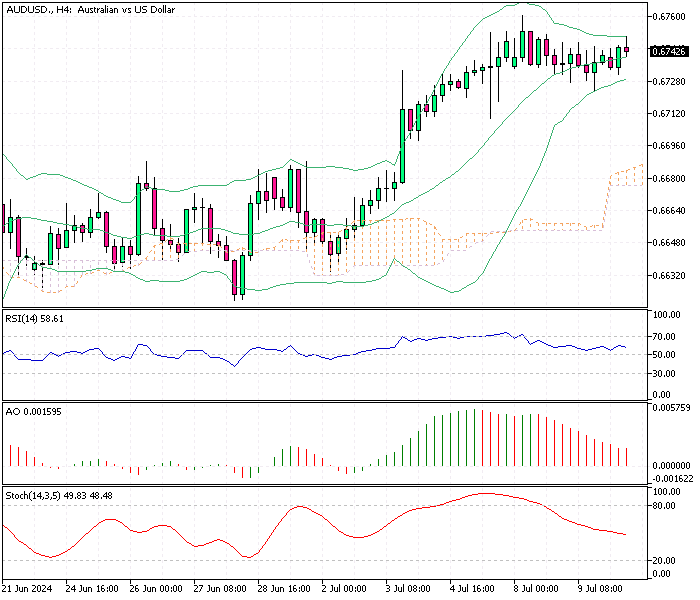

AUDUSD Analysis 10-July-2024

The Australian dollar held steady at around $0.674 as investors evaluated the Reserve Bank of Australia’s (RBA) future monetary policy based on mixed economic data.

Earlier this week, reports showed that consumer confidence in Australia fell in July, while business sentiment reached a 17-month high in June. Investors are now waiting for the July consumer inflation expectations data to be released later this week for more insights. The likelihood of an RBA rate hike has decreased, with markets now predicting only a 22% chance of an increase in August, down from 40% a few weeks ago.

AUDUSD Analysis 10-July-2024

However, the Australian dollar stayed strong compared to other currencies. This strength comes from expectations that the RBA might lag in the global rate-cutting trend or raise rates again due to high inflation in May.

Additionally, the Australian dollar rose against the New Zealand dollar after the Reserve Bank of New Zealand hinted at an earlier rate cut due to easing inflation.