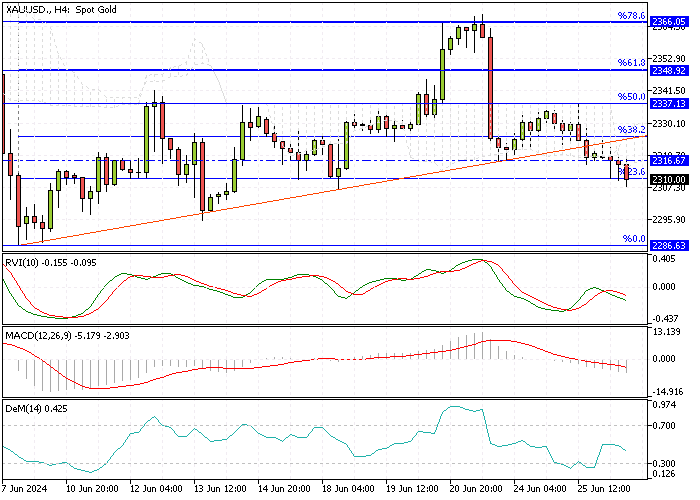

Gold Analysis – 26-June-2024

Gold prices dropped to approximately $2,310 per ounce on Wednesday, continuing their decline from the previous session. This downward trend is influenced by comments from Federal Reserve officials, signaling a cautious approach toward interest rate cuts.

Fed Governor Lisa Cook indicated that while a rate cut is inevitable, its timing remains uncertain. Additionally, Fed Governor Bowman expressed doubts about any rate cuts happening this year.

Gold Analysis – 26-June-2024

US Business Activity Peaks in June

These statements come amid vigorous U.S. business activity, which hit a 26-month high in June, reinforcing the Federal Reserve’s hawkish stance. Investors are now keenly awaiting Friday’s core Personal Consumption Expenditures (PCE) index data release.

The PCE index, favored by the Fed for gauging inflation, will provide critical insights, especially after recent data showed cooling in both the Consumer Price Index (CPI) and Producer Price Index (PPI).

Q1 GDP Growth Third Estimate Unveiled

Furthermore, Friday will reveal the third estimate for Q1 GDP growth, alongside consumer spending and income updates. These figures are pivotal as they offer a more comprehensive picture of the U.S. economy’s health and future trajectory. For investors, staying informed about these economic indicators is crucial for making well-grounded decisions in a volatile market.