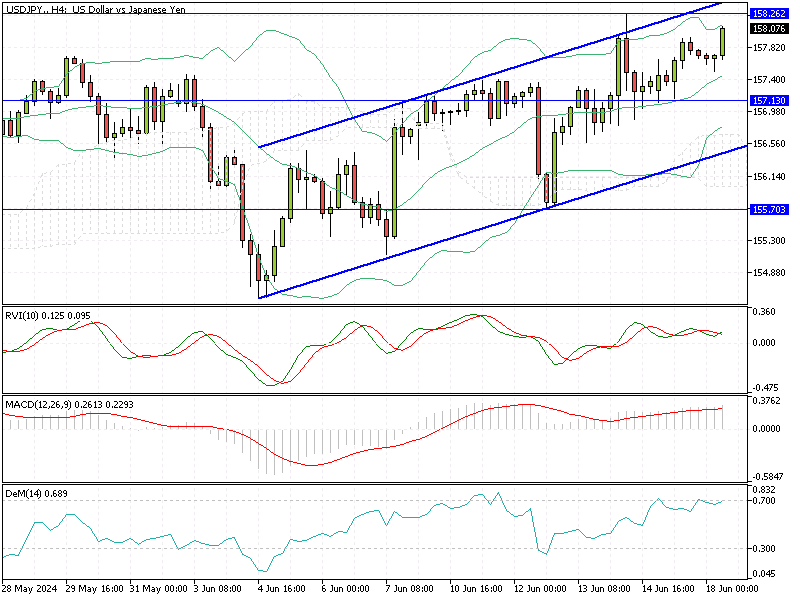

USDJPY Analysis – 18-June-2024

USD/JPY—The Japanese yen recently weakened to around 158 per dollar, continuing its decline following the latest decision from the Bank of Japan (BOJ). The currency has not rebounded despite BOJ Governor Kazuo Ueda’s hawkish comments.

During his address to the Japanese parliament, Governor Ueda indicated that the central bank might consider raising interest rates in July, contingent on forthcoming economic data.

USDJPY Analysis – 18-June-2024

Wage Increases to Balance Japan’s Imports

Ueda also acknowledged the challenges posed by the weak yen, particularly the higher import costs that could strain household spending. However, he emphasized that increasing wages might help offset these costs by boosting consumption. This balanced perspective highlights the delicate trade-offs in Japan’s current economic situation.

BOJ Keeps Rates Steady and Plans Bond Cut

Last week, the BOJ maintained its interest rates, as was widely anticipated. Additionally, the bank announced plans to reveal a strategy for reducing its bond-buying program at the upcoming July meeting. This news initially caused the yen to depreciate sharply, nearing its lowest level in over three decades.

However, the currency’s losses were somewhat mitigated as market participants refocused on the potential bond purchase reduction and possible currency interventions.

Summary

These developments suggest a period of economic uncertainty and potential volatility in the currency markets for investors and consumers. Staying informed about the BOJ’s future actions and economic indicators will be crucial for making well-informed financial decisions.