WTI Crude Steady Amid OPEC+ Meeting

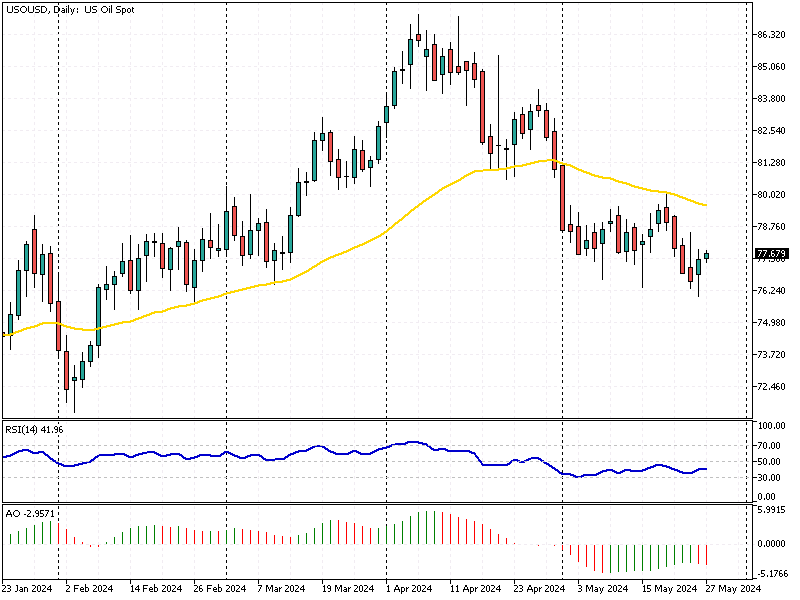

WTI crude futures remained stable at nearly $78 per barrel on Monday. Investors are cautious as they wait for the OPEC+ meeting on June 2. Primary producers are expected to extend voluntary output cuts through the end of the year.

WTI Crude Steady Amid OPEC+ Meeting

Bloomberg—OPEC forecasts robust oil demand growth of 2.25 million barrels per day for 2024. However, the International Energy Agency (IEA) predicts a weaker growth of 1.2 million bpd. This difference in outlooks is creating uncertainty in the market.

Market watchers monitor demand trends as the summer driving season begins in the Northern Hemisphere. This period often increases fuel consumption, which could influence oil prices.

Key Economic Indicators to Watch

Investors are also considering this week’s US PCE price index report. This report is crucial for insights into the Federal Reserve’s monetary policy. Additionally, Chinese PMI figures will be closely watched to better understand the demand outlook.

Recent Price Movements

Last week, oil prices dropped by more than 2%. This decline was due to robust US economic data and hawkish Federal Reserve minutes, reinforcing expectations that interest rate cuts would be delayed. This has added another layer of complexity to market predictions.

By staying informed about these factors, traders and investors can make better decisions in the volatile oil market.