Silver Soars to Highest Price Since 2012

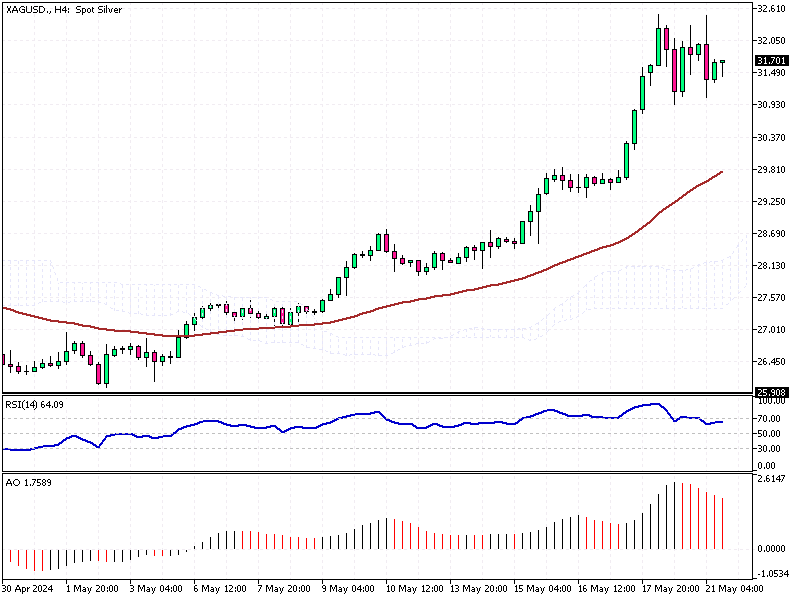

Silver prices have surged to nearly $32 per ounce, a level not seen since December 2012. This marks a remarkable year-to-date gain of almost 33%, capturing the attention of traders and investors alike.

Silver Soars to Highest Price Since 2012

The rise in silver prices is closely tied to the upward trend in the gold market. Investors are optimistic that the Federal Reserve will soon start cutting interest rates, with the first reduction expected as early as September. This potential shift in monetary policy is driving up the appeal of precious metals.

Geopolitical factors are also at play. The tragic helicopter crash that claimed the lives of Iranian President Ebrahim Raisi and Foreign Minister Hossein Amirabdollahian has heightened concerns about potential escalation in the Middle East. As a result, silver’s status as a safe-haven asset has been further solidified.

Solar Demand Boost

In addition to these factors, silver continues to benefit from its crucial role in solar panel production. Demand for solar panels is expected to hit a record high this year, pushing the silver market into its fourth consecutive deficit. This ongoing demand underscores silver’s importance in the renewable energy sector.

Investment Implications

Understanding these trends is key to making informed decisions for traders and investors. The combination of monetary policy shifts, geopolitical instability, and industrial demand suggests that silver may continue to shine soon.