Global Oil Supply Faces Multiple Threats

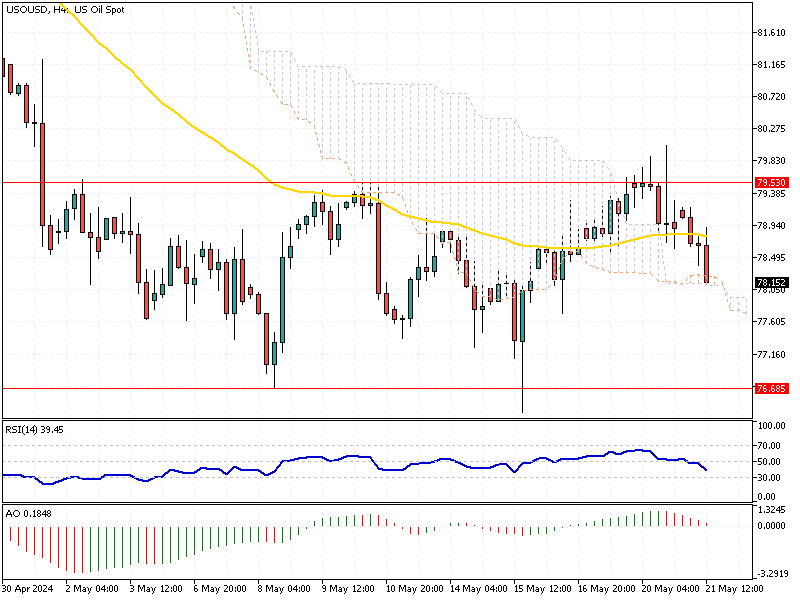

WTI crude futures fell to around $79 per barrel on Tuesday, continuing losses from the previous session. This drop came as investors assessed recent developments in the Middle East. The death of Iran’s president in a helicopter crash and the emerging health concerns of Saudi Arabia’s king contributed to market jitters.

Despite these events, there are no immediate signs of oil supply disruptions from the region, keeping the market somewhat stable.

Global Oil Supply Faces Multiple Threats

Investors are also cautiously awaiting the upcoming OPEC meeting on June 1. The possibility of a rollover of production cuts is on the minds of many. This decision could significantly impact oil prices and market dynamics. Traders are advised to stay informed about OPEC’s announcements as they could signal shifts in oil production strategies.

Global Supply Risks

Recent geopolitical events continue to pose risks to global oil supply. Ukraine’s attacks on Russian refineries and a Houthi missile strike on a China-bound oil tanker in the Red Sea have raised concerns. These incidents highlight the vulnerability of global oil supply chains and the potential for unexpected disruptions.

US Interest Rates and Demand

On the demand side, comments from Atlanta Fed President Raphael Bostic indicated that US interest rates might rise higher than markets currently expect. He compared the potential rate levels to those seen in the 1990s. Higher interest rates could dampen economic growth and, subsequently, oil demand. Investors should monitor US economic indicators closely as they can influence oil market trends.