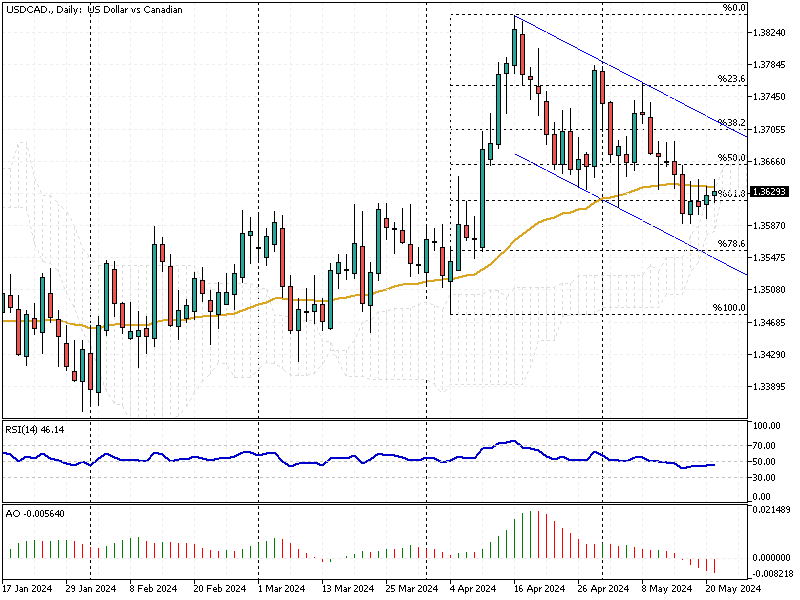

USDCAD – Strong Canadian Labor Market

The Canadian dollar strengthened to about $1.36 (USD/CAD) in May, reaching a five-week high. This change is due to lower US inflation, which has weakened the US dollar. The latest US CPI data increased expectations that the Federal Reserve might cut interest rates in September. Both headline and core inflation are anticipated to ease, making rate cuts more likely.

USDCAD – Strong Canadian Labor Market

In contrast, Canada’s domestic labor market has shown impressive strength. April’s unemployment rate stayed below expectations at 6.1%, and net employment jumped by 90,000. This is the most significant increase in 15 months, far exceeding the forecasted rise of 18,000. Such robust labor data gives the Bank of Canada (BoC) more flexibility to keep its current restrictive monetary policy longer.

Boost in Business Confidence

Adding to the positive outlook, Canadian business confidence has surged to a two-year high of 63. This figure surpassed expectations, reflecting strong optimism in the private sector. Such confidence is crucial for sustained economic growth and stability.

Conclusion

For forex traders and investors, these developments highlight the Canadian dollar’s potential for continued strength. The interplay between softer US inflation and robust Canadian economic indicators presents a unique landscape. Monitoring these trends can help you make informed trading decisions.