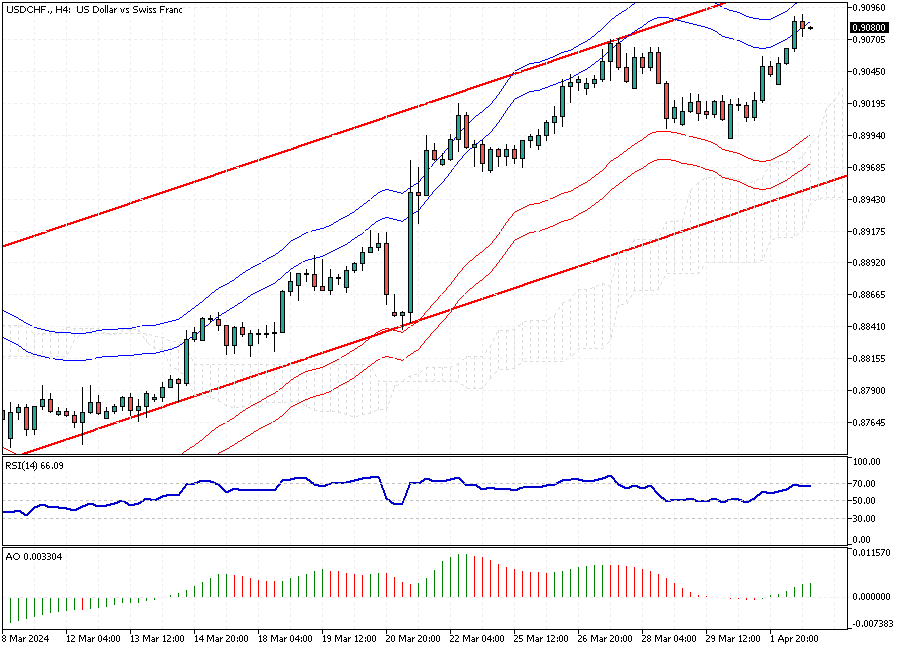

Swiss Franc Hits 5-Month Low Amid Fed Policy Divergence

USDCHF Analysis – In late March, the Swiss franc fell to 0.9 against the US dollar, marking its lowest point in almost five months. This happened as the Swiss National Bank (SNB) and the Federal Reserve followed different monetary policies. The SNB surprised everyone by cutting its primary interest rate by 25 basis points to 1.5% during its March meeting when many had expected it to remain unchanged.

This move made it the first major central bank to reduce rates after global disinflation began in 2023. Along with the rate cut, the SNB also significantly lowered its inflation expectations for Switzerland, predicting that inflation would stay below 1.5% for some time despite the government stopping its utility subsidies.

With inflation expected to remain low, the central bank eased its efforts to support the franc, leading to an increase in foreign currency reserves for the third consecutive month in February, after they had hit a seven-year low in November. Meanwhile, the Fed decided not to change its interest rates, as ongoing high inflation posed a risk of delaying any potential rate cuts.