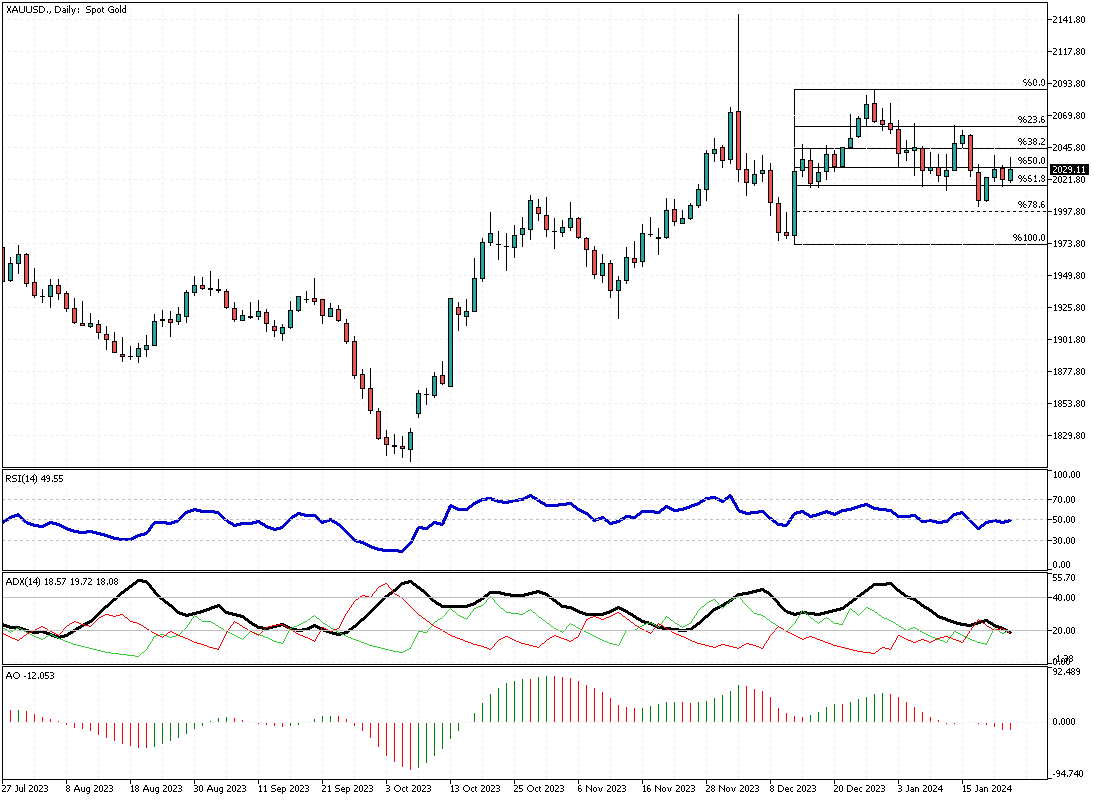

Gold Analysis – January-23-2024

On Tuesday, the price of gold surged, reaching approximately $2,030 per ounce. This increase came as a recovery from previous losses, coinciding with the dollar’s retreat from its recent peak levels. This shift in gold’s value is happening against a backdrop of ongoing global scrutiny of monetary policies. Market analysts and investors closely monitor these developments to understand their impact on various investment assets, including precious metals like gold.

Global Central Banks’ Monetary Strategies

In Asia, the focus was on the Bank of Japan, which decided to continue its extremely accommodating monetary policy. This decision, which aligned with market expectations, also included a reduction in their inflation projections for the year 2024, which was attributed mainly to falling oil prices. Meanwhile, attention in Europe turns to the European Central Bank, which is poised to make key decisions regarding its monetary policy later in the week. There is a general anticipation that the ECB will counter the expectations of interest rate reductions. These decisions are pivotal in shaping the economic landscape and influencing market trends and investor strategies.

Anticipation of Key Economic Data and Federal Reserve’s Decisions

The United States market is in a state of anticipation, awaiting crucial economic data releases. This week, key figures regarding private sector activities, Gross Domestic Product (GDP), and Personal Consumption Expenditures (PCE) inflation are expected. These data points are particularly significant as they precede the Federal Reserve’s policy meeting scheduled for the following week. As indicated by CME’s FedWatch Tool, current market sentiment shows a dwindling probability of less than 50% for a Federal Reserve rate cut in March. This is a notable decrease from the previous week’s 81% expectation. These evolving expectations and the forthcoming Federal Reserve decisions will likely be major determinants in the short-term movements of the currency and precious metals markets.