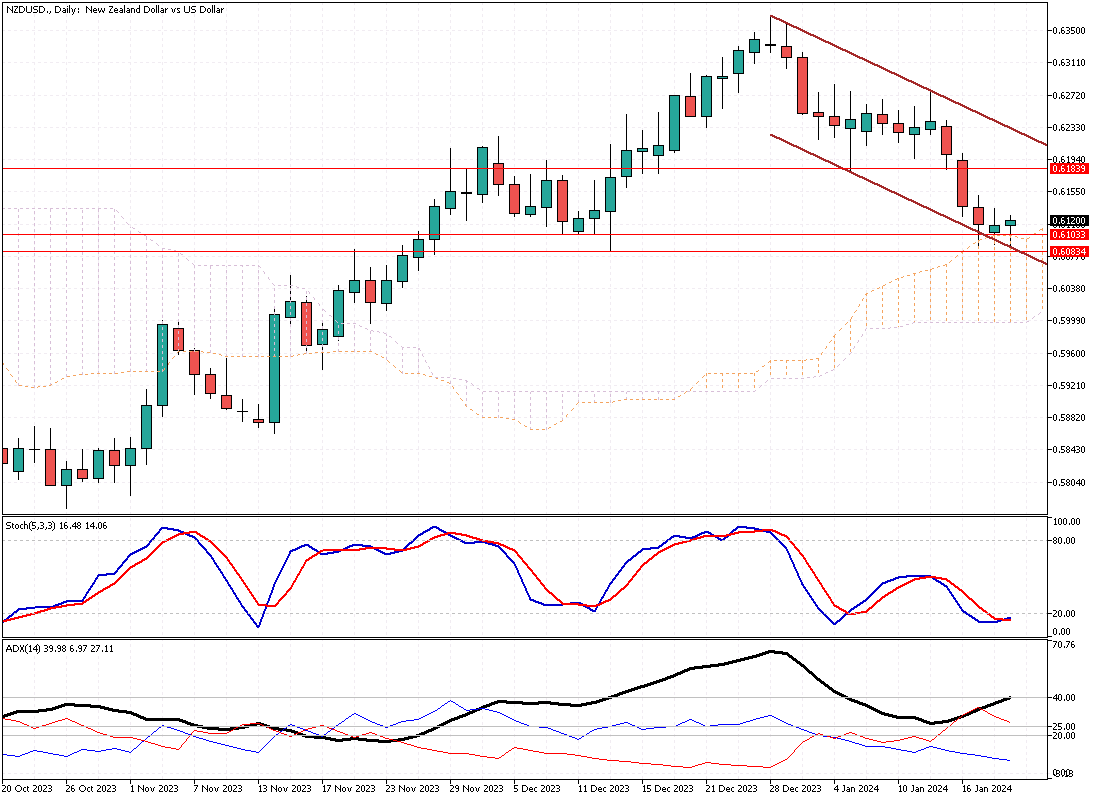

NZDUSD Analysis – January-19-2024

The NZDUSD currency pair maintained its position around $0.61, closely approaching its five-week low. This trend can be attributed to strong economic data from the United States and the firm stance of Federal Reserve officials, which collectively have lowered expectations for interest rate cuts. Additionally, the currency is experiencing downward pressure due to a growing consensus that domestic interest rates in New Zealand may have reached their peak. Financial markets are currently factoring in an anticipated easing of about 100 basis points over this year.

Investors are now keenly awaiting a forthcoming speech by Paul Conway, the Chief Economist of the Reserve Bank of New Zealand. In this speech, expected later in the month, Conway is predicted to challenge the prevailing dovish outlook. This address is particularly significant as it may provide insights into the Reserve Bank’s future monetary policy direction and its impact on the New Zealand economy.

NZDUSD Analysis – Daily Chart

Another positive development is that recent data indicates a significant improvement in business confidence in New Zealand during the fourth quarter. The statistics reveal a notable shift in sentiment, with only a net 2% of firms anticipating a deterioration in business conditions. This figure is a stark improvement from the previous quarter, where pessimism prevailed among 52% of firms. This change in business outlook is an encouraging sign for the New Zealand economy, suggesting potential resilience and adaptability in the face of global economic challenges.