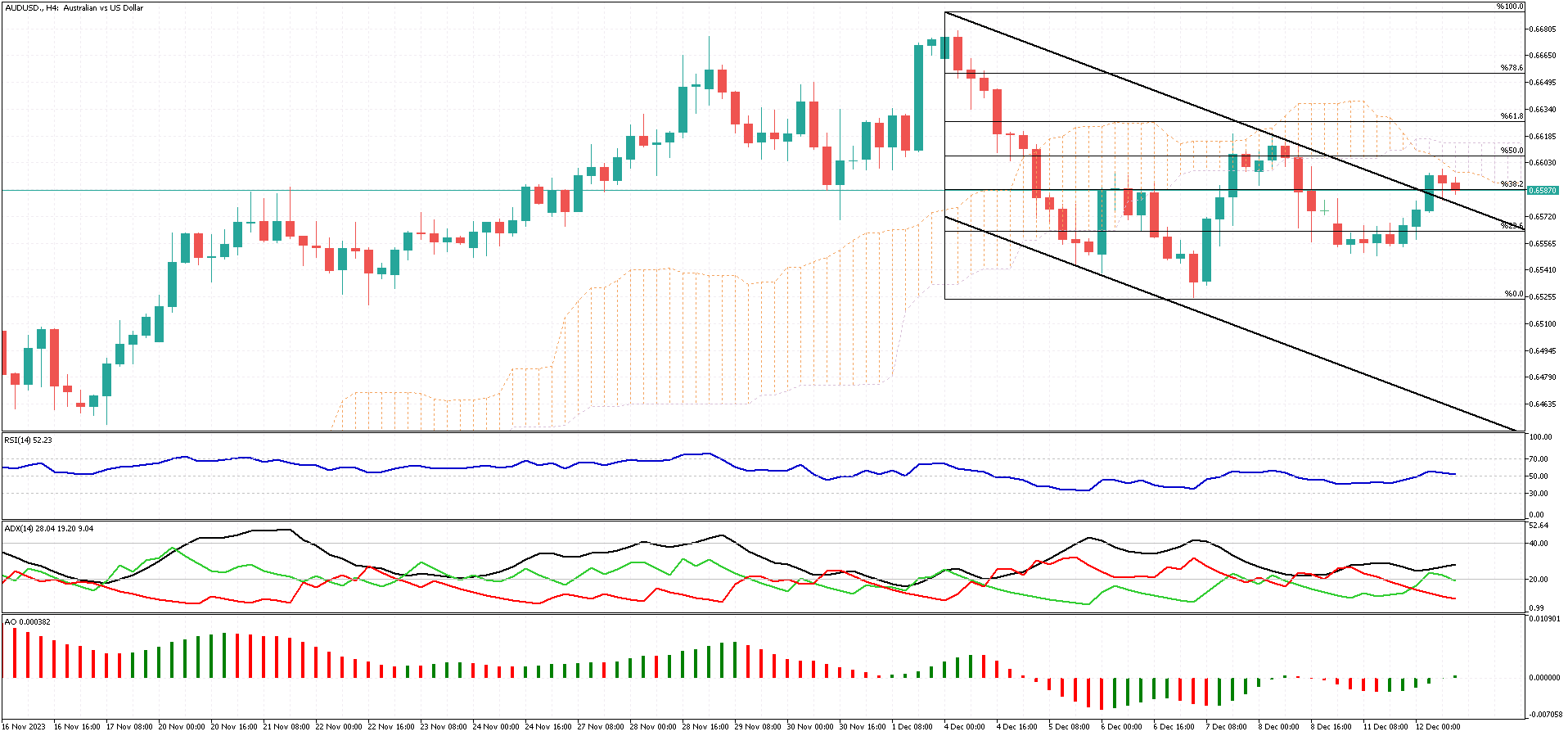

AUDUSD Analysis – December-12-2023

The currency pair has shown a notable uptrend, breaking out of its previous bearish channel. This positive movement is supported by the Awesome Oscillator climbing above its signal line and the RSI (Relative Strength Index) staying above the median line, indicating a bullish trend. However, a significant challenge remains as the pair trades beneath the Ichimoku cloud.

Buyers must push and sustain the price above the Ichimoku cloud to solidify this upward trend. Conversely, a drop in the AUDUSD price below the 23.6% support level might indicate a resumption of the downward trend.

10-Year Yield Unchanged in Australia

Bloomberg – The yield on Australia’s 10-year government bonds remained steady above 4.3%. This stability reflects investors’ ongoing evaluation of the global economic situation and interest rate trends. Additionally, they await upcoming US inflation data and decisions from vital central banks this week.

In Australia, recent data indicates that consumer sentiment in 2023 has been one of the lowest on record, mainly due to rising living costs and high interest rates. Furthermore, business sentiment experienced a downturn in November, with a general decline in optimism across various industries.

Regarding monetary policy, Michele Bullock, the Governor of the Reserve Bank of Australia, mentioned a cautious approach to monetary policy. She emphasized the importance of considering new data and affirmed Australia’s commitment to the global fight against inflation. Despite this, market analysts predict that the Reserve Bank of Australia might halt further tightening measures. They also foresee a slower pace for Australia in bringing inflation back to the target level compared to other major economies.