Canadian Stocks Continue to Fall

On Friday, the S&P/TSX Composite and Canadian stocks indices slightly dipped below the break-even point, hovering around 19,550. This continued the downward trend observed throughout the week, fueled by new worries about stricter financial conditions in the United States.

Global Impact of US Bond Yields

Reuters – The lackluster demand for long-term bonds in the United States led to increased yields on government debt worldwide. This effect was amplified by comments from Federal Reserve Chair Powell, who highlighted the possibility of needing to raise interest rates. In the same session, Barrick Gold and Agnico Eagle saw their shares fall by nearly 1%, mirroring the downturn in gold and copper prices. Despite the overall market decline, banks and energy producers experienced minor gains. A slight rise in crude oil prices helped the latter group.

Looking at the week, the S&P/TSX Composite index was on track to fall by almost 1.5%.

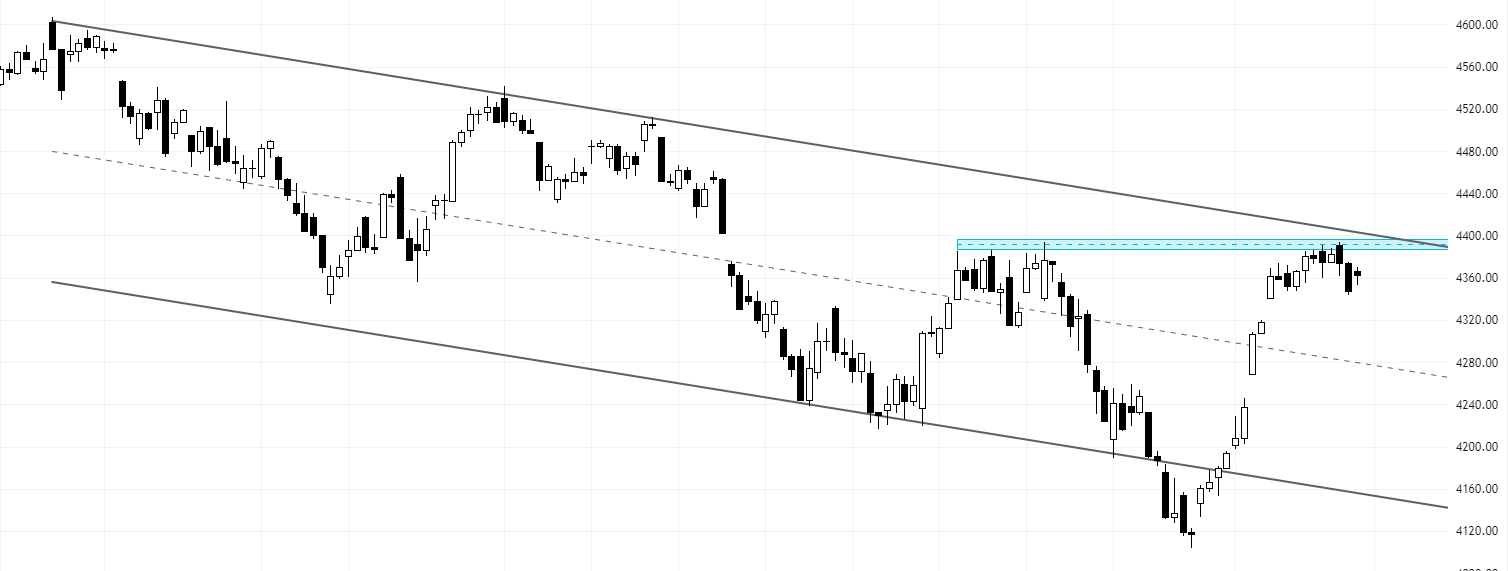

SPX Daily Chart

Economic Implications

In terms of the economy, such market trends can have mixed effects. On one hand, falling stock prices could indicate investor uncertainty, which can slow economic growth. On the other hand, the slight gains in specific sectors suggest some areas of the economy are still performing well. Therefore, it’s difficult to definitively say whether it’s good or bad for the economy. It largely depends on how these factors evolve.